When Dutch (institutional) investors invest into an LP or when a private equity structure invests into a Dutch target company, it is always a bit tricky and complex, because the Dutch entity tax classification rules for Dutch and foreign entities (such as LPs) are quite unique and deviate from international standards. This often causes “hybrid entity mismatches” and complexities in an international context, in particular in private equity structures.

As of January 1, 2025, the Dutch entity tax classification rules for Dutch and foreign entities (LPs) will be overhauled to bring them more in line with international standards. Transitional rules already apply during 2024.

These changes are generally for the better, but in certain cases there may be an effect on existing private equity structures. Therefore they should be reviewed at short notice, mainly to ensure that structures can still be restructured by year-end, if necessary.

With a focus on LPs in private equity structures, this article will provide a helicopter view of the current and the new Dutch entity tax classification rules and the transitional rules, as well as some example private equity structures.

Dutch Entity Tax Classification Framework

Current rules

The Netherlands applies the “similarity approach” to classify foreign entities. In short, this approach means that one looks at the most similar Dutch equivalent of the foreign entity (“corporate resemblance”) to determine its Dutch tax classification.

Under the current rules, Dutch LPs (commanditaire vennootschappen) can be classified as transparent or nontransparent for Dutch tax purposes. A Dutch LP qualifies as transparent if the admission or replacement of a limited partner requires the unanimous consent of all (general and limited) partners (the infamous “consent requirement”). In all other cases, it is considered nontransparent. The consent requirement is somewhat unique because the international standard is that only the prior consent of the general partner is needed for the admission or transfer of a limited partner.

Consequently, foreign LPs often do not meet the consent requirement and are therefore considered nontransparent for Dutch tax purposes. Hence, for non-Dutch LPs with a Dutch investor/investment, this often causes “hybrid entity mismatches” in an international context.

New rules apply in 2025

The Similarity Approach remains

The similarity approach remains the primary classification method (the key word is “equivalency”). Under the new rules, the consent requirement will finally be abolished, and Dutch nontransparent LPs will cease to exist (for this reason, there are transitional rules for 2024 — see below). Hence, starting in 2025, all Dutch LPs will be transparent from a Dutch tax perspective. This also means that foreign LPs (and foreign entities that are equivalent to a Dutch LP) will be tax transparent, which aligns with international standards and will largely eliminate hybrid entity mismatches for LPs.

Anglo-Saxon LPs and the Luxembourg SCSp are typically equivalent to a Dutch LP, so, starting in 2025, those foreign LPs are thus considered transparent from a Dutch tax perspective. U.S. corporations, U.S. limited liability companies, and Anglo-Saxon Limiteds are typically equivalent to a Dutch private LLCs (besloten vennootschap) and thus continue to be considered nontransparent from a Dutch tax perspective from 2025 on.

Equivalent?

For other types of foreign entities, the question is whether there is a Dutch equivalent.

The Dutch Ministry of Finance recently published a draft decree (Concept Besluit vergelijking buitenlandse rechtsvormen) which was open for consultation to the public. It addresses the new legal framework for comparing foreign entities with Dutch legal forms, which should apply as of January 1, 2025. Among other things, the decree contains an annex with a list of foreign entities that have already been (pre)classified for Dutch tax purposes.

Only a limited number of entities is included on this list (which will be expanded over time). Based on the list, for example, the U.K. limited liability partnership and Luxembourg société en commandite par actions (SCA) have no clear Dutch equivalent.

When there is no equivalent?

For foreign entities without a clear Dutch equivalent, there will be two new classification approaches:

- foreign entities that are not Dutch tax residents will follow the tax classification in their home jurisdiction (“symmetric approach”);

- foreign entities that are Dutch tax residents will be classified as nontransparent (“fixed approach”).

For example, the U.K. LLP and Luxembourg SCA do not have a Dutch equivalent and will (assuming they are not Dutch tax residents) therefore follow the classification in their home jurisdiction. This means that, as of 2025, the U.K. LLP will be considered transparent and the Luxembourg SCA will be considered nontransparent for Dutch tax purposes. The symmetric approach is helpful because it reduces or avoids hybrid mismatches.

Dutch FGR

Though this article is focused on LPs, it is worth mentioning that (at least in the Dutch market, but less suitable for private equity structures) an often-used fund vehicle is the Dutch fund for joint account (fonds for gemene rekening or FGR). Under both the current and the new Dutch entity tax classification rules, an FGR can remain transparent as well as nontransparent from a Dutch tax perspective (though the classification rules for FGRs will also be amended).

2024 Transitional rules

Following the new classification rules, entities (for example, Dutch LPs and foreign LPs) that are currently considered nontransparent may become transparent for Dutch tax purposes (or vice versa). This could be a tax-trigger moment at the entity level and/or at the level of its participants.

To mitigate any adverse effect of the new classification rules, the Dutch government has introduced several restructuring facilities that apply during 2024. One should therefore analyze whether it is necessary to restructure during 2024.

Albeit not often used in private equity structures, one can think of a Dutch LP that is currently nontransparent and that will become tax transparent as of 2025. Another situation is a foreign LP that is currently nontransparent and subject to Dutch corporate income tax as a nonresident taxpayer (e.g., because it holds a direct investment in Dutch real estate) and will become transparent starting in 2025. Under certain conditions, a rollover facility can be applied to avoid a “dry” tax charge (but not all situations are covered by these transitional rules).

Example

Introduction

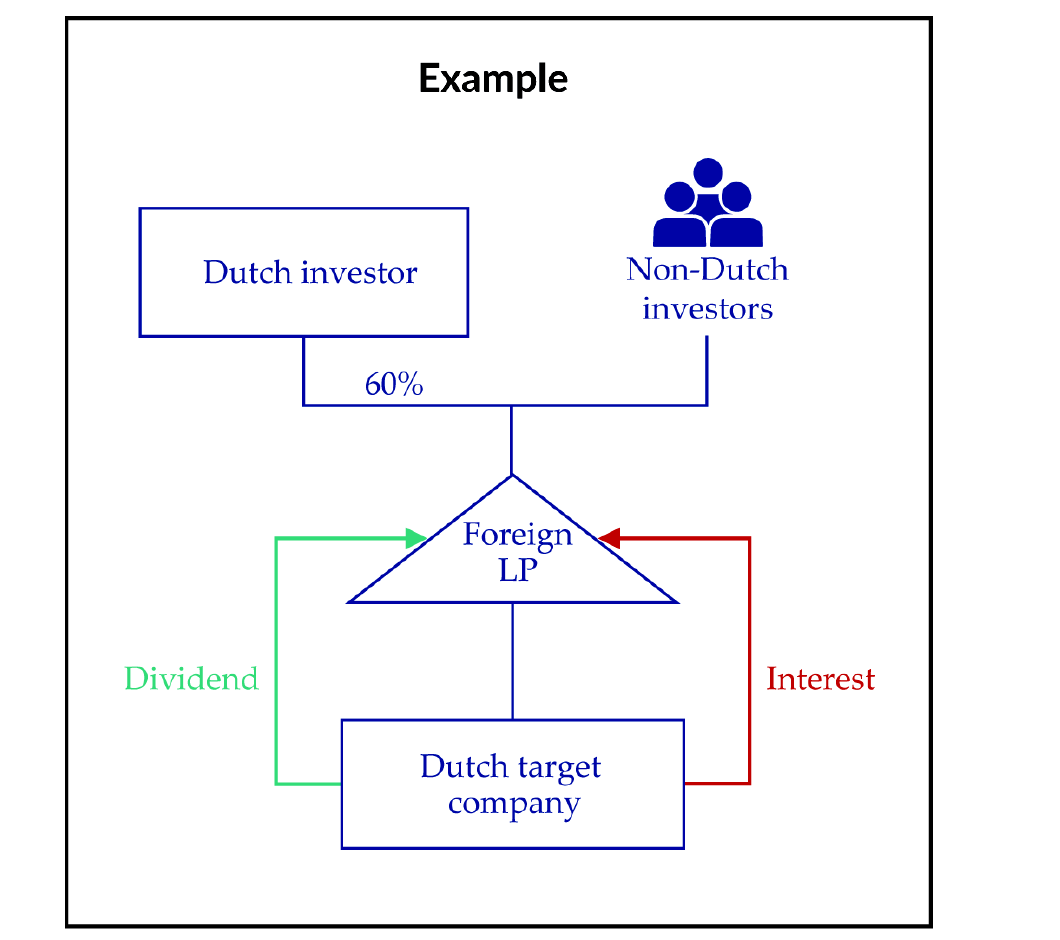

To put the current and new Dutch tax entity classification rules into perspective, see the figure below for a simplified example of a private equity structure in which a foreign LP (e.g., Anglo-Saxon LP or Luxembourg SCSp) with Dutch and non- Dutch investors that invest into a Dutch target company. We will discuss the Dutch tax aspects of the current and new classification rules for the Dutch investor, the LP, and the Dutch target company.

In this example, the Dutch target company is held 100 percent by the LP, which, in turn, is held 60 percent by a Dutch taxable investor. The remaining interest in the LP is held by non-Dutch investors. The Dutch target company makes interest and dividend payments to the LP. Further, the LP does not meet the consent requirement and is therefore considered nontransparent for Dutch tax purposes and because it is considered tax transparent in its jurisdiction of establishment, it qualifies as a hybrid entity for Dutch tax purposes. The LP will, however, also become transparent for Dutch tax purposes as of January 1, 2025 (and thus stop qualifying as a hybrid entity).

Dutch Investor

The Dutch investor has a participation in shares in the LP for Dutch tax purposes. On January 1, 2025, once the LP becomes transparent, the Dutch investor is deemed to dispose of its shares in the LP against fair market value. Because the Dutch investor holds more than 5 percent of the interest in the LP (and assuming that all other conditions for the Dutch participation exemption are met), any capital gain or loss is exempt for Dutch corporate income tax purposes.

Thereafter, the Dutch investor is deemed to have a direct participation in the Dutch target company for Dutch tax purposes. This also means that, to apply the Dutch participation exemption, one should consider whether the participation in the Dutch target company meets all requirements (which should generally be the case).

Also, because of the transparency of the LP, the interest payments made by the Dutch target company will become taxable at the level of the Dutch investor starting January 1, 2025.

Foreign LP

Following the EU second Anti-Tax Avoidance Directive (2017/952/EU, or ATAD 2), all EU member states have implemented anti-hybrid mismatch rules in their domestic legislation. ATAD 2 aims to prevent situations of a double deduction and a deduction without a corresponding inclusion of the income resulting from hybrid mismatches.

If the LP is established in another EU member state, like Luxembourg, how the investors classify the LP becomes relevant. This is because, based on the ATAD 2 rules, an LP must be treated as a regular taxpayer (reverse hybrid) if 50 percent or more of its investors classify the LP as nontransparent (like the above structure, the Dutch investor but possibly also some other European investors). In practice, it is burdensome for fund managers to monitor this requirement. Starting January 1, 2025, Dutch investors will stop causing this reverse hybrid entity mismatch.

Dutch target company

ATAD 2

The ATAD 2 rules are also relevant at the Dutch target company level. Based on the ATAD 2 rules, the interest expenses of the Dutch target company will be treated as nondeductible if the corresponding interest income is not taxed at the level of the recipient(s) because of a hybrid entity mismatch. This is the case in the above example during 2024, because the interest income is currently neither taxed at the level of the LP nor at the level of the Dutch investor due to the difference in classification of the LP (and assuming it is not treated as a reverse hybrid in its own jurisdiction).

Starting January 1, 2025, the LP will become transparent for Dutch tax purposes and as a result, the Dutch investor will recognize the interest income and will no longer cause this hybrid mismatch (and the interest will be deductible for the Dutch target company insofar as no other interest deduction limitation rule applies).

Dutch Dividend Withholding Tax

Profit distributions by the Dutch target company are in principle subject to 15 percent Dutch dividend withholding tax (DWT). However, if certain conditions are met, an exemption is available for corporate shareholders.

In case of hybridity, the DWT rules may lead to overkill. This is the case under the current classification rules if the LP is tax transparent in its own jurisdiction and nontransparent from a Dutch tax perspective. If so, the LP does not meet all conditions under the main rule of the DWT exemption. Nevertheless, an exemption is still available for LPs if the following conditions are met:

- all limited partners in the LP consider it to be transparent; and

- each limited partner would have been entitled to the DWT exemption if they had held their interest in the Dutch company directly.

These requirements are often not met in private equity structures with widely held LPs because this exemption follows an “all-ornothing” approach. This means that the exemption is disallowed for all investors if even one investor does not qualify (like the Dutch investor in this example).

Under the new classification rules, the LP will become transparent for Dutch DWT purposes (and the all-or-nothing approach will no longer apply for distributions to the LP). Whether the DWT exemption applies should therefore be tested at the level of each investor. The overkill will thus disappear as of 2025.

Dutch Conditional Withholding Tax

The Netherlands introduced a conditional withholding tax (CWT) at a rate of 25.8 percent on interest and royalty payments (as of January 1, 2021) and dividend payments (as of January 1, 2024). This CWT is levied on payments to related parties that (1) are established in certain lowtaxed or blacklisted jurisdictions, (2) qualify as a hybrid entity, or (3) in certain other situations that are perceived as “abusive.” Parties are considered related under these rules if one can exercise control over the other (e.g., if one entity indirectly holds more than 50 percent of the voting rights in the other). The interests of entities that are considered to “act together” should be aggregated for this test.

As foreign LPs are generally nontransparent for Dutch tax purposes, the CWT rules should be tested at LP level. Returning to the example, if the LP would be established in a low-taxed or blacklisted jurisdiction (like Jersey, Guernsey, the Cayman Islands, the British Virgin Islands, etc.), any dividend, interest, or royalty payments by the Dutch target company to the LP are subject to CWT. No domestic exemption is available for this situation.

However, if the LP would not be established in a low-taxed or blacklisted jurisdiction, payments to the LP are often still in scope of the CWT rules (because the LP currently qualifies as a hybrid entity from a Dutch tax perspective).

However, an exemption can be invoked if it is plausible that:

- every related participant in the LP:

- considers the LP to be transparent and is therefore in its own jurisdiction considered to be the direct recipient of the income obtained by the LP; and

- would not be subject to CWT if the LP would not have been interposed; or

- there are no related participants in the LP.

Going back to the example, the LP does not qualify for this exemption because the Dutch investor does not consider the LP to be transparent. Like the DWT exemption for hybrid situations, this exemption follows an all-or-nothing approach and embeds overkill.

Only for dividend payments, in 2024 an additional relief applies to hybrid entities (LPs) that will become transparent as of January 1, 2025. In this situation, the rules should (already) be tested at the level of each individual participant. Please note that this relief only applies if the LP is not established in a low-taxed or blacklisted jurisdiction and only in relation to dividend payments (i.e., not for interest and royalty payments).

Under the new classification rules, the LP will become transparent for Dutch CWT purposes. These rules should then be tested at the level of each investor only. This would only be different if the investors in the LP consider it to be nontransparent for local tax purposes (which should no longer be the case for Dutch investors).

Takeaways

The various tax aspects in the simplified private equity example above show that the new Dutch entity tax classification rules will generally be an improvement over the current regime because there will no longer be hybridity (from a Dutch tax perspective). Nevertheless, as the current Dutch classification rules have been around for a long time, every structure should be checked on a case-by-case basis to avoid surprises starting January 1, 2025.

This publication was published by Tax Notes International. Download the complete edition below.

Downloads

Tax Notes International