Background

As of 1 January 2022, the Netherlands has anti-abuse legislation against double non-taxation resulting from transfer pricing mismatches. In the case of transfers of assets and liabilities through contributions, distributions, mergers and demergers, the Dutch corporate income tax (CIT) basis for the recipient is at maximum (for assets) or at minimum (for liabilities) the value included in the transferor’s tax base, based on Article 8bd Dutch Corporate Income Tax Act (CITA). The wording of this provision led to uncertainty on the scope of this legislation in relation to the transfer of participations that qualify for the participation exemption and the application of the Dutch participation exemption as such.

On 17 March 2025, the DTA published a KG Position in which they clarify the application of the participation exemption in relation to subsidiaries whose tax basis is potentially impacted by Article 8bd CITA.

KG Positions contain the DTA’s analysis of the tax aspects of specific cases presented to the respective KG. As KG Positions constitute policy of the DTA, taxpayers can rely on such positions as of their publication date.

Facts and circumstances

This KG Position analyses the application of the participation exemption in the following situation:

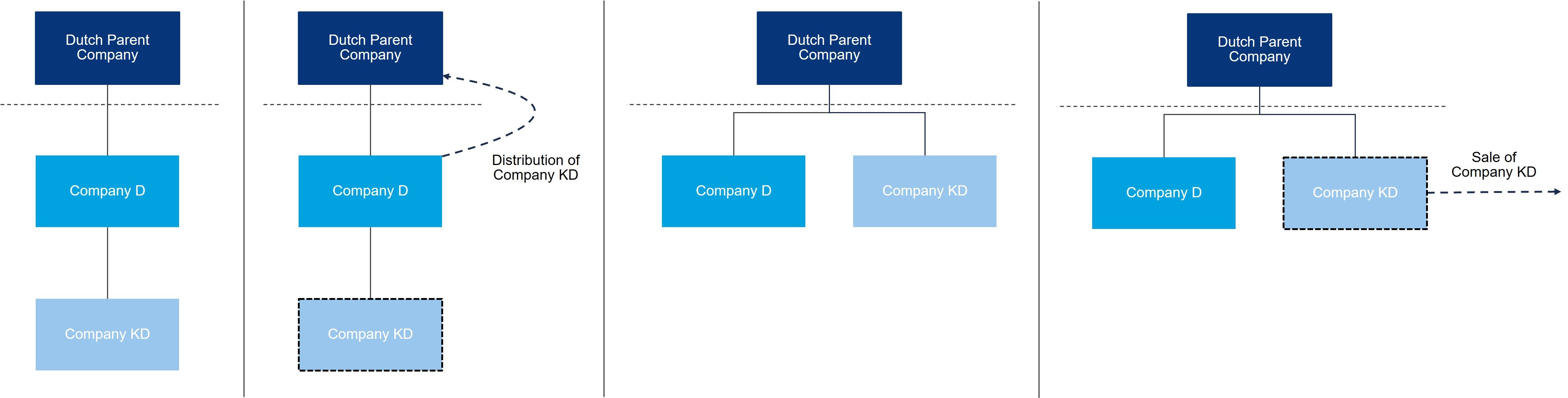

A Dutch Parent Company owns all shares in a foreign subsidiary, Company D. Company D holds all shares in another foreign subsidiary, Company KD. At a certain point in time, the Dutch Parent Company acquires the shareholding in Company KD from Company D by means of a profit distribution. The market value (90) of Company KD at that moment is higher than the value that Company D includes in its (foreign) profit tax base in respect of this transfer. The conditions to apply the participation exemption are met in relation to Company KD. At a certain point in time after the acquisition of Company KD, the Dutch Parent Company sells its interest in Company KD for 210. Reference is also made to the illustration below.

Due to the potential application of the transfer pricing mismatch legislation (Article 8bd CITA), the Dutch Parent Company could be obliged to include Company KD on its tax balance sheet for a lower value than the fair market value at the time of acquisition. If the transfer pricing mismatch legislation is applicable, it would result in a higher gain upon disposal of that subsidiary, compared to the situation without application of the Dutch transfer pricing mismatch rules. The question came up whether the full gain made for CIT purposes in respect of such disposal would be exempt under the participation exemption.

KG Position

The KG Position clarifies that the participation exemption applies to the full amount of the gain, irrespective of the potential application of Article 8bd CITA.

Our view

This KG Position on the application of the participation exemption offers clarification of the DTA’s view on the interaction of the Dutch transfer pricing mismatch legislation with the Dutch participation exemption. The KG Position is beneficial to taxpayers. It should furthermore, in our view, have a broad scope of application, including (conceptually) comparable fact patterns. To obtain certainty in advance, particularly in situations that differ from the fact pattern covered by this KG Position or where uncertainty exists regarding the application of the participation exemption as such to a specific subsidiary, taxpayers may consider applying for an advance tax ruling.

Should you have any questions on this topic, please contact your regular trusted Loyens & Loeff contact or one of the contact persons mentioned below.