Below we outline the main items of these new sets of Jan 2025 AG, being the fifth release of guidance complementing the OECD (Consolidated) Commentary to the GloBE Rules after the guidance released in February 2023, July 2023, December 2023 and June 2024. Additionally, we highlight the main items of the Q&A to the Transitional Qualified Status, the GIR and the GIR MCAA.

Although jurisdictions generally have two years to implement new administrative guidance, jurisdictions that have implemented the Jan 2025 AG early seem to be able to apply the new guidance to apply the so-called Switch-Off Rule under the QDMTT Safe Harbour to Constituent Entities in jurisdictions that have not yet implemented the new guidance.

Background

On 20 December 2021, the OECD/IF released GloBE Rules for the IIR and the UTPR (see our earlier tax flashes). Subsequently, the European Union approved the Pillar 2 Directive (EU Directive) closely following the GloBE Rules. In the years following the release of the GloBE Rules, the OECD/IF introduced “Commentary” and “Guidance” to “clarify” the GloBE Rules. Regularly, however, the additional commentary and guidance conflict with the GloBE Rules and the EU Directive.

Limitation on use of DTAs

Art 9.1 of the GloBE Rules sets forth transitional provisions allowing deferred tax accounting attributes, such as DTAs incurred before the Transition Year to be factored into the effective tax rate (ETR) calculation. This rule intends to avoid distortions when an MNE Group becomes subject to the GloBE Rules.

The Jan 2025 AG includes guidance on the application of the Article 9.1 of the GloBE Rules, notably on the treatment of certain DTAs that arose prior to the Transition Year (Transition Rules) as a result of certain governmental arrangements, retroactive elections, or following the introduction of a new corporate income tax, after 30 November 2021. The Jan 2025 AG provides additions to (i) the limitations under Article 9.1.2 of the GloBE Rules, (ii) the limitations under Article 9.1.3 of the GloBE Rules, as well as to (iii) the Transitional CbCR Safe Harbour and QDMTT Safe Harbour. With respect to the new limitations introduced for DTAs under Articles 9.1.2 and 9.1.3 the guidance allows for a Grace Period (limited use of in-scope DTAs).

Although the Jan 2025 AG seems to suggest that this guidance contains clarifications on the application of the limitations set forward in the transitional rules, the guidance clearly amends and may substantially limit the use of pre-existing DTAs.

MNE Groups should carefully review the possible effect of these amendments and to which extent these amendments can be applied by implementing jurisdictions. This is particularly relevant given the potential impact on fiscal year 2024, which may need to be taken into account for tax provision purposes. Below we set out the revisions to the Transitional Rules as intended by the OECD/IF.

Article 9.1.2 of the GloBE Rules aims to limit the exploitation of differences between GloBE Income or Loss and taxable income through DTAs reflected or disclosed in the financial accounts of a Constituent Entity (CE) in the Transition Year. If Article 9.1.2 of the GloBE Rules applies, the respective DTAs are not available for GloBE purposes (preventing an increase in the GloBE ETR that would otherwise occur upon reversal of such DTAs).

The Jan 2025 AG provides additional considerations to the scope of Article 9.1.2 of the GloBE Rules by first reiterating the two main cumulative requirements that DTAs must fulfil for Article 9.1.2 of the GloBE Rules to apply:

- the DTA must arise from items excluded from the computation of GloBE Income or Loss under Chapter 3 of the GloBE Rules (computation of GloBE Income or Loss), and

- the DTA must be generated in a transaction that takes place after 30 November 2021.

Please see a further explanation of (i) and (ii) below.

Ad (i) Items excluded from the computation of GloBE Income or Loss under Chapter 3

The Jan 2025 AG states that the reference to ‘items excluded from the computation of GloBE Income or Loss under Chapter 3’ not only includes DTAs attributable to items expressly excluded by Chapter 3 of the GloBE Rules, but also:

- DTAs associated with non-economic expenses or losses for tax purposes,

- DTAs that are not attributable to the prepayment of tax in relation to income that would or will be included in GloBE Income or Loss, and

- tax benefits designed to achieve similar effects as sub a., including tax credits based on future expenditure or activity unless a DTA relates to tax credits that arise independently of a governmental arrangement (see more on “governmental arrangements” below).

According to the Jan 2025 AG, Article 9.1.2 of the GloBE Rules does not apply to:

- DTAs relating to a tax credit that would arise in absence of a governmental arrangement; and

- DTAs, or a portion thereof, taken into account under Article 6.2.1(c) of the GloBE Rules.

Ad (ii) Transaction that takes place after 30 November 2021

The limitation under Article 9.1.2 of the GloBE Rules only applies to DTAs related to items listed in (i) above where they are generated in a “transaction” that takes place after 30 November 2021.

According to the Jan 2025 AG, for the purposes of Article 9.1.2 of the GloBE Rules, the term “transaction” is newly defined as not being limited to commercial transactions but should be interpreted broadly to include:

- any agreement, ruling, decree, grant or similar arrangement with a General Government (so-called ‘governmental arrangement’), and

- any amendment or modification to a pre-existing governmental arrangement.

A harmful transaction under the Jan 2025 AG exists if a potentially harmful DTA, as defined under the first criterion (i), is based either on a commercial transaction or is based on a new or amended governmental arrangement, provided that it could not have been obtained independently of such arrangement.

The Jan 2025 AG has provided three exemplary illustrative types of transactions pursuant to which tax attributes that are based on such transactions are excluded from Article 9.1.1 of the GloBE Rules as per Article 9.1.2 of the GloBE Rules (also provided they fulfil the first criterion outlined above):

- DTAs attributable to a governmental arrangement concluded or amended after 30 November 2021 where such governmental arrangement provides the taxpayer with a specific entitlement to a tax credit or other tax relief (including, for example, a tax basis step-up) that does not arise independently of the arrangement (Benefits arising from governmental arrangements).

- DTAs that are attributable to an election or choice exercised or changed by a CE after 30 November 2021 and that retroactively changes the treatment of a transaction in determining its taxable income in a tax year for which an assessment by the tax authority was already made or a tax return was already filed (Retroactive elections).

- DTAs or deferred tax liabilities (DTL) arising from a difference in the tax basis or value and accounting carrying value of an asset or liability if the tax basis or value was established pursuant to a corporate income tax that was enacted by a jurisdiction that did not have a pre-existing corporate income tax and that was enacted after 30 November 2021 and before the Transition Year (Newly enacted CIT legislation).

The Jan 2025 AG states that a deferred tax expense attributable to a DTA or DTL which stems from items excluded from the computation of GloBE Income or Loss under Chapter 3 of the GloBE Rules (criterion (i)) and triggered as part of a transaction as described in the three subparagraphs (a) to (c) above (criterion (ii)) is excluded from the Total Deferred Tax Adjustment Amount under Article 4.4 of the GloBE Rules and Simplified Covered Taxes under the Transitional CbCR Safe Harbour, subject to the Grace Period described below

The Jan 2025 AG also excludes the DTAs arising under governmental arrangements, retroactive elections, or newly enacted CIT legislation excluded under Article 9.1.2 of the GloBE Rules from the definition of Other Tax Effects for the purposes of Article 9.1.3 of the GloBE Rules., i.e. such DTAs cannot be considered by the acquiring Constituent Entity.

If a DTA fulfils both criteria (i) and (ii) outlined above and is thus in in scope of the Jan 2025 AG, the amount of deferred tax expense stemming from the reversal of such DTA can still be considered to compute the Total Deferred Tax Adjustment Amount under Article 4.4 of the GloBE Rules or Simplified Covered Taxes under the Transitional CbCR Safe Harbour during a Grace Period, and up to 20% of each such DTA originally recorded taken into account at the lower of the Minimum Rate (i.e., 15%) or the applicable domestic tax rate. This Grace Period only applies to the DTAs mentioned in examples a. to c. above.

The Grace Period includes:

- for deferred tax expenses attributable to the reversal of a DTA arising under a governmental arrangement or a retroactive election, all Fiscal Years beginning on or after 1 January 2024 and before 1 January 2026, but not including a Fiscal Year that ends after 30 June 2027, and

- for deferred tax expenses attributable to the reversal of a DTA arising from the enactment of new CIT legislation, all Fiscal Years beginning on or after 1 January 2025 and before 1 January 2027, but not including a Fiscal Year that ends after 30 June 2028.

Furthermore, the Jan 2025 AG entirely excludes the application of the Grace Period to deferred tax expenses attributable to DTAs arising under governmental agreements, retroactive elections or newly enacted CIT legislation dating after 18 November 2024. Therefore, the deferred tax expenses attributable to such DTAs (fulfilling both criteria (i) and (ii) of the Jan 2025 AG) are excluded from the application of the Grace Period and not available for either GloBE purposes or Transitional CbCR Safe Harbour purposes. In addition, any changes to the terms of existing governmental arrangements, any new elections or changes in CIT legislation after that date which would result in higher amounts being taken into account during the Grace Period are disregarded. The additional amount that reverses compared to the amount that would have reversed absent the change is excluded. The underlying rationale is to avoid an acceleration of the reversal of DTAs to increase the amount of deferred tax expenses that can be taken into account in the Grace Period.

For the amount of DTAs allowed under Article 9.1.3 the guidance expressly refers to the new limitations set out for Article 9.1.2. As such, the Grace Period indirectly also applies to these DTAs under 9.1.3.

For purposes of the Simplified ETR Test under the Transitional CbCR Safe Harbour, the Jan 2025 AG, in addition to uncertain tax positions, also excludes from the Simplified Covered Taxes deferred tax expenses attributable to the reversal of DTAs and DTLs arising under governmental arrangements, retroactive elections, or newly enacted CIT legislation excluded under Article 9.1.2 of the GloBE Rules. An exception is provided to still include deferred tax expenses in the Simplified Covered Taxes (up to the maximum amount of 20%) during the Grace Period, provided eligible for such Grace Period. It is noted that the amendment to the calculation of the Simplified Covered Taxes does not extend to other DTAs excluded under Article 9.1.2 of the GloBE Rules.

The impact of the EU Directive should be assessed, considering that, based on Article 32 of the Pillar 2 EU Directive, all EU Member States must have provided their consent in order for it to be a ‘qualifying international agreement on safe harbours’.

The Jan 2025 AG furthermore introduces an additional Switch-Off Rule relating to the QDMTT Safe Harbour. This rule applies when a QDMTT jurisdiction does not exclude the DTAs arising under governmental arrangements, retroactive elections, or newly enacted CIT legislation excluded under Article 9.1.2 of the GloBE Rules from determining the Adjusted Covered Taxes or the applicability of the Transitional CbCR Safe Harbour under the QDMTT. In such cases, the Switch-Off Rule prevents the concerned MNE Group from applying the QDMTT Safe Harbour in relation to its CEs located or created in the QDMTT jurisdiction. Consequently, the MNE Group must switch to the credit method for the QDMTT. This will result in jurisdictions with an IIR or UTPR to collect Top-up Tax as the Safe Harbour will not apply.

Additionally, when a MNE Group is required to apply the Switch-Off Rule by virtue of the above, additional information must be provided to the relevant jurisdiction(s) with taxing rights in respect of the QDMTT jurisdiction. The IF will develop a framework for the reporting of such information by MNE Groups in connection with their GIR.

The impact hereof for the EU Directive should be assessed, considering that based on Article 32 of the EU Directive all EU Member States must have provided their consent in order for it to be a ‘qualifying international agreement on safe harbours’.

As mentioned, according to the Jan 2025 AG, all additions relating to deferred taxes in the Transition Period are labelled as mere clarifications. However, the question may arise whether the Jan 2025 AG potentially extends beyond clarification, which in turn may be seen as materially changing the existing GloBE Rules and the interpretation thereof under the existing Commentary to the GloBE Rules, potentially preventing certain jurisdictions from applying the guidance in full or part.

Central Record of Transitional Qualified Status Jurisdictions

The OECD/IF also published the Central Record and updated its Q&A on the Qualified Status under the global minimum tax, including the lists of jurisdictions that have enacted legislation with qualified status for a transitional period for (i) the IIR, and (ii) the DMTT and the QDMTT Safe Harbour, along with the effective dates per country. The Central Record generally includes the jurisdictions that have adopted the global minimum tax legislation. Although Portugal and South Africa have adopted a global minimum tax legislation, they are not included in the Central Record. None of the jurisdictions included on the list would, based on the Transitional Qualified Status, disqualify from having a Qualified IIR or a DMTT that qualifies for the QDMTT Safe Harbour.

It is worth noting that the Switch-Off Rule could still apply, even if the QDMTT Safe Harbour is applicable. Unfortunately, the Central Record does not outline if a Switch-Off Rule indeed applies. Such Switch-Off Rule implies that for a subset of CEs, a credit mechanism for the QDMTT still applies. This also means that additional calculations with respect to such CEs under the IIR and/or UTPR are still needed, potentially resulting in (additional) Top-up Tax.

The relevant legislation in the Central Record will be treated as qualified as from the effective date of the legislation and the Central Record will be updated regularly.

The full qualified status needs to be established via peer review, consisting of a full legislative review and ongoing monitoring by the IF. The Q&A does not address the full review process. Because it is not possible to conduct a full peer review in the short term for each jurisdiction that has implemented the GloBE Rules and/or a QDMTT as of 2024, the IF developed a simplified procedure of the transitional qualification mechanism.

The transitional qualification mechanism is based on self-certification by an implementing jurisdiction. Information on main features of the national legislation is shared with all members of the IF. If no questions are received, or if questions from IF members are resolved, the legislation is recorded as having Transitional Qualified Status. No Transitional Qualified Status is granted if questions from IF members are not resolved, and the Working Party agrees (on a consensus-minus-one basis) that the jurisdiction’s legislation does not qualify. An implementing jurisdiction can self-certify based on the draft legislation.

Subject to the self-certification, the Transitional Qualified Status is expected to be established within 12 months after the effective date of the legislation and apply from the effective date. The full review is expected to start no later than two years after the legislation's effective date and the Transitional Qualified Status will end once the full review is completed.

The Q&A highlights aspects of the implementation and administration of the qualified status and transitional qualified status of the domestic minimum tax rules. The Q&A closely reassembles the Q&A in this respect published in June 2024.

The Q&A does not address the contents of the qualification rules as such.

The Q&A explains that the consistent application of three types of domestic charging provisions (QDMTT, IIR, UTPR) relies on the qualified status of the domestic rules. For instance, only a payment of Top-up Tax under QDMTT will be creditable against Qualified IIR or Qualified UTPR in another jurisdiction (in absence of the QDMTT Safe Harbour being applicable).

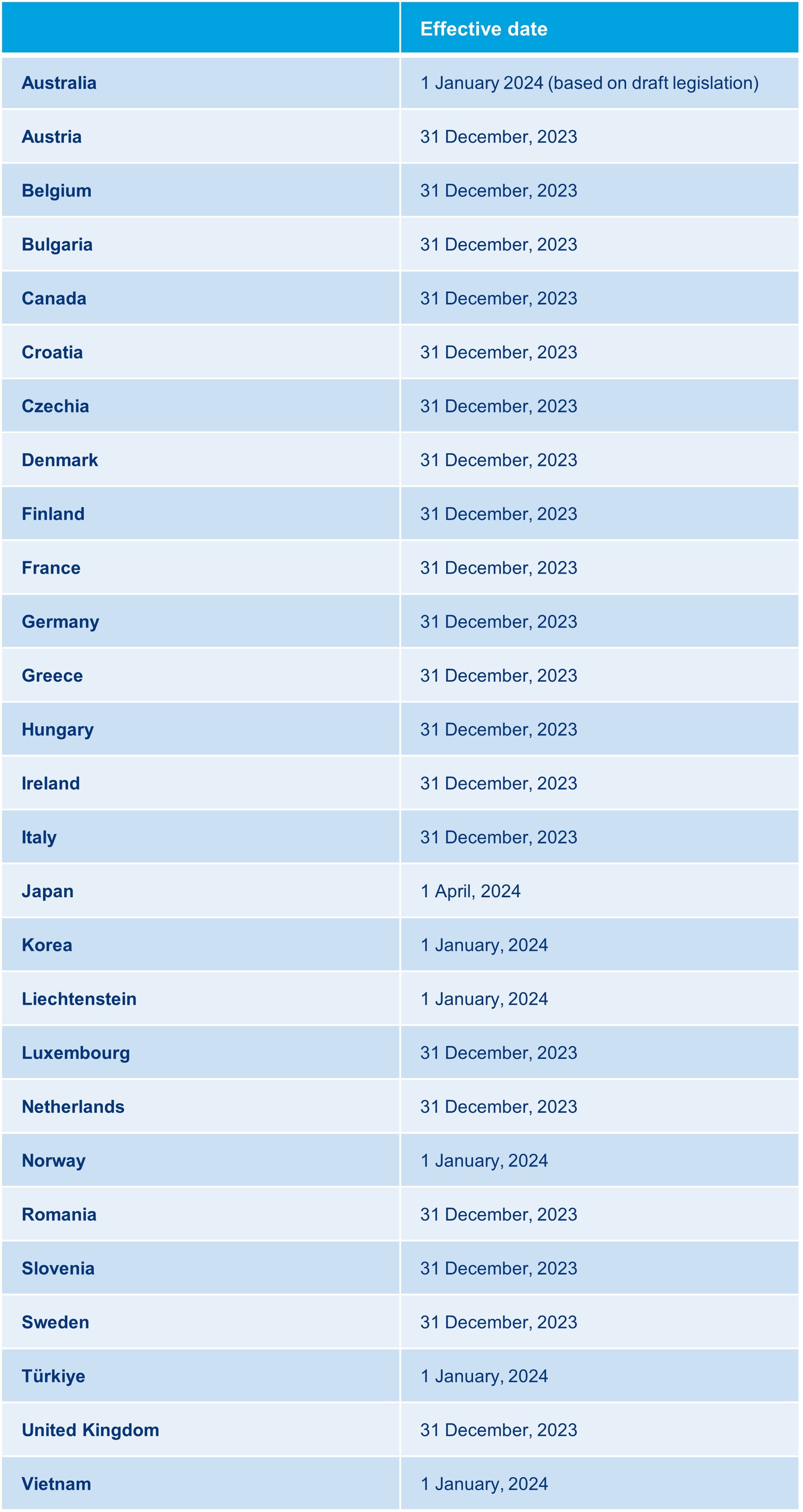

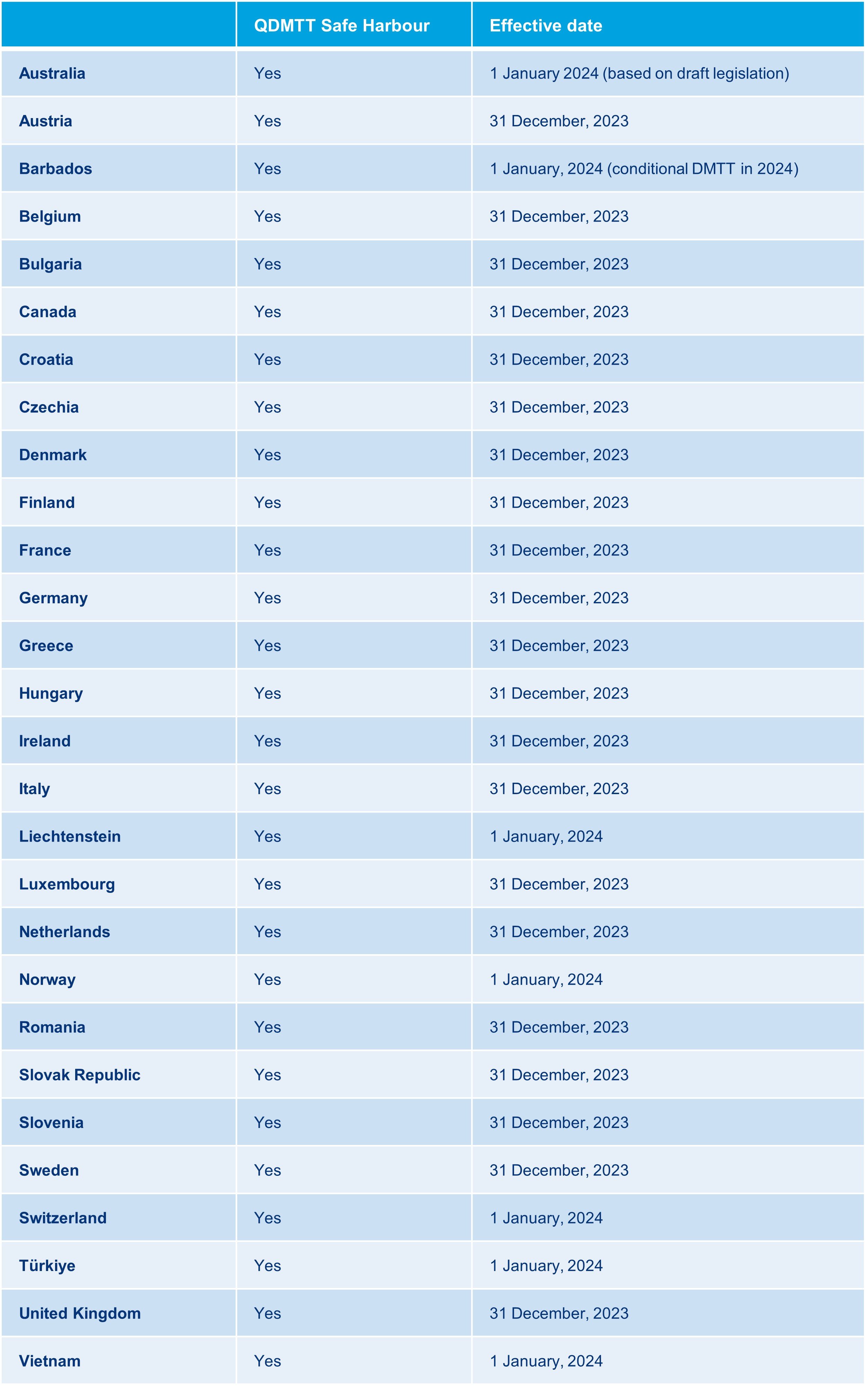

The following jurisdictions and effective dates have been listed in the Central Record.

Updated GIR and GIR Guidance

The OECD/IF included guidance on Articles 8.1.4 and 8.1.5 of the GloBE Rules in the Jan 2025 AG as well as published the GIR Jan 2025, being an update to the GIR that was initially released in July 2023. These documents incorporate the following noteworthy simplifications and clarifications which are the result of stakeholder feedback.

By default, MNE Groups must complete the data points in the GIR based on the GloBE Rules and Commentary. The Jan 2025 AG provides simplification where a single jurisdiction has taxing rights under the GloBE Rules or where a QDMTT Safe Harbour applies. In these cases, requiring the information to be reported based on the GloBE Rules and Commentary would increase the compliance burden since subsequent tax returns are based on domestic rules. The Jan 2025 AG therefore requires that the relevant sections of the GIR are completed based on the domestic legislation of the jurisdictions with those taxing rights. Using the GloBE Rules and Commentary as the single source to complete the GIR could result in using different data points than those used under the local legislation of an implementing jurisdiction with taxing rights. The Jan 2025 AG requires MNE Groups to report the impact of those differences on key indicators in the GIR.

A new annex B to the GIR includes a notification template that jurisdictions can use when they require MNE Groups to notify them that the GIR will be provided through information exchange (see paragraph on the GIR MCAA below). The standard GIR notification template aims to reduce the compliance burden for MNE Groups. Although considered best practice, jurisdictions are not required to implement this particular GIR notification template. However, jurisdictions are encouraged to avoid requesting additional information. Jurisdictions may request annual notifications but have the flexibility to simplify the process by only requiring notifications if there are subsequent changes.

A new Annex C to the GIR describes the transitional penalty relief for MNE groups in the initial years after the GloBE Rules have come into effect. It is intended to reflect a common understanding amongst jurisdictions on the necessity to provide relief to taxpayers in those cases where an MNE has taken reasonable measures to ensure the correct application of the GloBE Rules and the QDMTT. This common understanding requires that jurisdictions give careful consideration as to the appropriateness of applying penalties or sanctions in such cases.

GIR Multilateral Competent Authority Agreement

By default, each CE is required to file a GIR within the stipulated deadline in the jurisdiction in which it is located. Article 8.1.2 of the GloBE Rules provides for a derogation in case the GIR is either filed by the Ultimate Parent Entity or by a so-called Designated Filing CE (a GIR Filing Entity). This is only applicable when the jurisdiction in which the GIR Filing Entity is located (GIR Filing Jurisdiction) has a Qualifying Competent Authority Agreement (QCAA) in place with the jurisdiction where the relevant CE is located.

The OECD/IF now published the GIR MCAA, which is a QCAA as defined in the GloBE Rules. Once signed and in effect, the GIR MCAA could ultimately facilitate that only one GIR is filed by an in-scope MNE Group.

The GIR Filing Jurisdiction would in such case exchange the relevant information with other relevant jurisdictions. This also means that these other jurisdictions do not receive the full GIR, but solely the information they are entitled to, based on the Dissemination Approach:

- The General Selection, containing general information on the MNE Group as a whole, is to be provided to (a) IIR and/or UTPR jurisdictions (Implementing Jurisdictions) where the Ultimate Parent Entity or Constituent Entities are located and under certain circumstances (b) QDMTT-only jurisdictions. In case of the latter, the high-level summary of the GloBE information in section 1.4 of the GIR is not provided.

- The Jurisdictional Selections, providing detailed information on the GloBE Rules and the QDMTT, are provided to jurisdictions that have taxing rights under the GloBE Rules or the QDMTT for such jurisdictions. Specific rules are in place for UTPR jurisdictions that effectively do not get any UTPR allocated. It is not required for Top-up Tax to actually arise.

- If the UPE is located in an Implementing Jurisdiction, this jurisdiction is provided with all Jurisdictional Selections.

The information generally needs to be exchanged within three months after the filing deadline in the GIR Filing Jurisdiction. If the GIR is filed thereafter, a three-month period for exchanging the information still applies. Provisions are also in place in case the GIR requires a correction.

The GIR Filing Jurisdiction is not required to have implemented the GloBE Rules or QDMTT. However, the Convention on Mutual Administrative Assistance in Tax Matters must be in force or in effect. Additionally, it must have a legal and operational framework available to allow for domestic filing of GIRs and permit the international exchange of information included in the GIR. This is subject to peer review.

Accordingly, for example the US – not being an Implementing Jurisdiction nor having a QDMTT in place – could be a GIR Filing Jurisdiction, provided it meets the above requirements.

The next step is for jurisdictions to sign the GIR MCAA and provide certain notifications in relation to the information they would intend to send and receive under the GIR MCAA and the jurisdictions for which this holds.

Note that in October 2024, the European Commission already submitted its proposed amendments to the Directive on Administrative Cooperation in the field of taxation to facilitate the filing and exchanging of GloBE related information between EU Member States, referred to as the “DAC9” proposal. For more details in this respect, we refer to our webpost.

How can we support you?

The GloBE Rules have been introduced in the EU and other jurisdictions around the world for years starting on or after 31 December 2023 at the earliest. The Jan 2025 AG contains technical details that can impact the calculation of the GloBE ETR or the Simplified ETR for Transitional CbCR Safe Harbour purposes in various scenarios.

Our Pillar Two team is available to support you in analysing and modelling the impact of this new guidance and the GloBE Rules in general on your group, assisting you in setting up compliance processes and exploring ways to mitigate increased administration, taxation and complexity.

Should you have any questions, please contact a member of our Pillar Two team or your regular trusted contact at Loyens & Loeff.