Key elements of the CSDDD

1. Scope:

-

- Applies to both EU and non-EU companies meeting specific financial and operational thresholds (please be referred to our cheat sheet on this here).

2. Background and Objectives of the CSDDD:

-

- Effective from 25 July 2024, the CSDDD promotes sustainable and responsible corporate practices by mandating that certain companies identify and address adverse impacts on human rights and the environment throughout their operations and value chains, both within and beyond the EU. Member States are required to transpose the directive into national law by 26 July 2026.

3. Main obligations under the CSDDD and the Proposal:

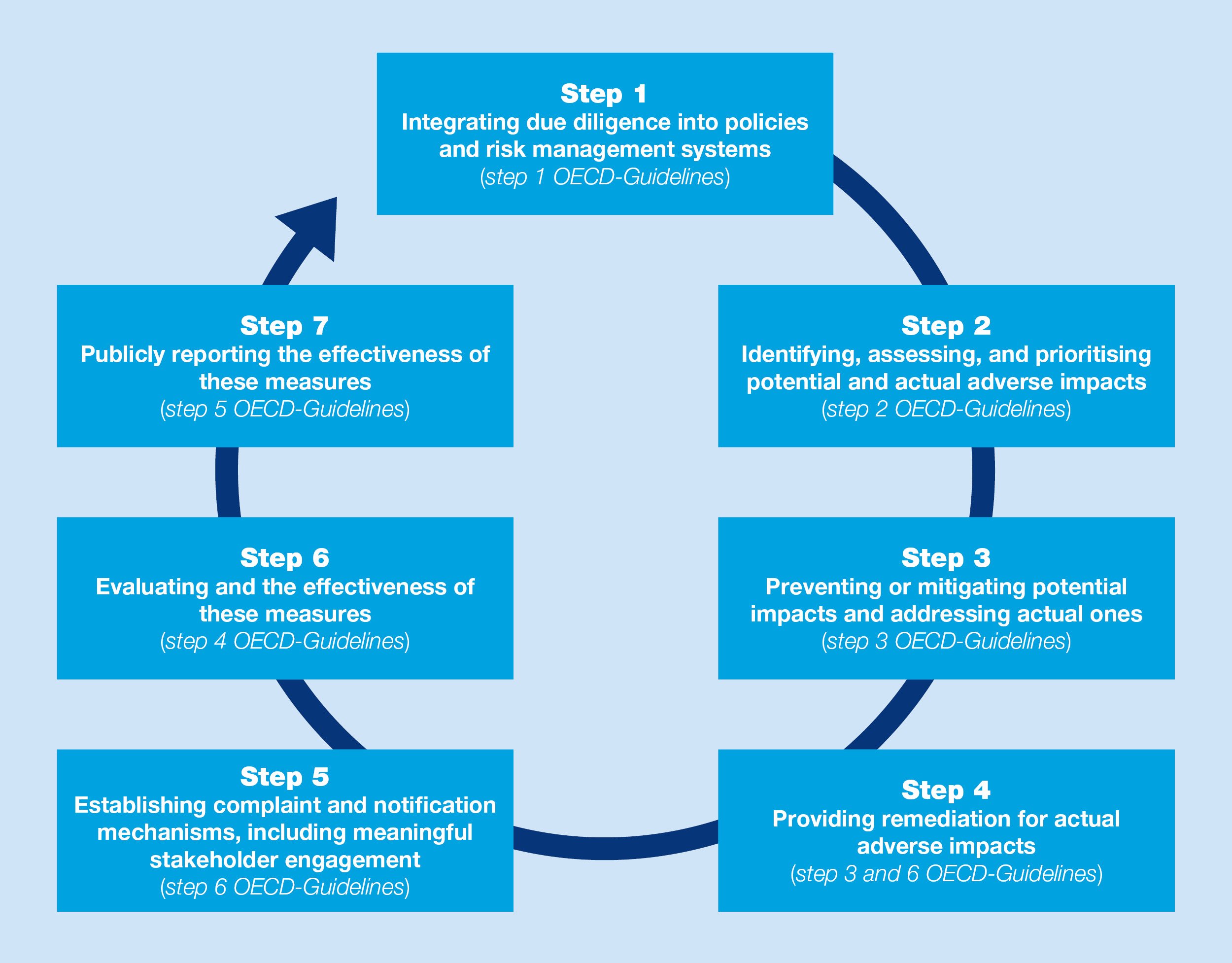

Risk-based due diligence process

- in-scope companies must adopt a risk-based due diligence process to manage human rights and environmental risks. Below we included the main elements of which this due diligence process must consist according to the explanatory statement (Memorie van Toelichting) attached to the Proposal (including the reference to the OECD guidelines, on which the CSDDD is based).

- This due diligence process applies to:

- In-scope company’s own operations;

- Operations of subsidiaries; and

- Business partners across their value chains.

Climate Change Transition Plan

- In-scope companies are required to adopt a climate change transition plan which should include at least the following (according to the Proposal):

- the transition to a sustainable economy;

- the 1.5 °C target of the Paris Agreement; and where relevant, the exposure of the company to coal-, oil- and gas-related activities;

- the climate change transition plan must contain clear and time-bound targets related to climate change for 2030 and in five-year steps up to 2050 based on conclusive scientific evidence and, where appropriate, absolute emission reduction targets for greenhouse gas for scope 1, scope 2 and scope 3 greenhouse gas emissions for each significant category;

- decarbonizations actions and key measures to achieve target, including potential changes to products, services or technology adoptions;

- overview of investments and funding to support the climate change transition plan; and

- the role of (executive) directors and supervisory bodies of the in-scope company in drafting and implementing the climate change transition plan.

How the corporate model and strategy can be aligned with the aforementioned goals will vary from sector to sector and from (in-scope) company to company. However, for each sector and in-scope company, the climate change transition plan must be compatible with the transition to a sustainable economy and limiting global warming and be science-based. The European Commission's guidelines will provide practical guidance at a later stage.

Key elements of the Proposal

The CSDDD has caught up with several Dutch ESG regulatory legislative proposals and initiatives, such as the Child Labour Duty of Care Act (which for the time being has been withdrawn according to the Proposal) and the Dutch Responsible and Sustainable International Business Act (which seems to be replaced by the (implementation of the) CSDDD and therefore the Proposal).

According to the Proposal (please be referred to the website of the Dutch legislator here), the CSDDD will be implemented in the Netherlands through a new standalone law, as existing legal instruments under Dutch Law are unsuitable for introducing the CSDDD's horizontal due diligence framework for large in-scope companies. According to the Proposal, the Dutch government aims to minimize administrative burdens, strictly including only the provisions necessary for compliance. Certain definitions, such as those related to the environment and royalties, have been clarified for effective application.

While the CSDDD permits stricter rules, the Proposal generally avoids this, except for allowing in-scope companies to share information or resources within their group or with other entities to support compliance with the climate change transition plan obligations. For the avoidance of doubt: The duty of care of directors of in-scope companies was already excluded from the CSDDD (please be referred to our earlier blog on this here). However, EU member states have discretionary authority to include such duty of care in their national implementation of the CSDDD. The Proposal does not include such duty of care for directors of in-scope (Dutch) companies.

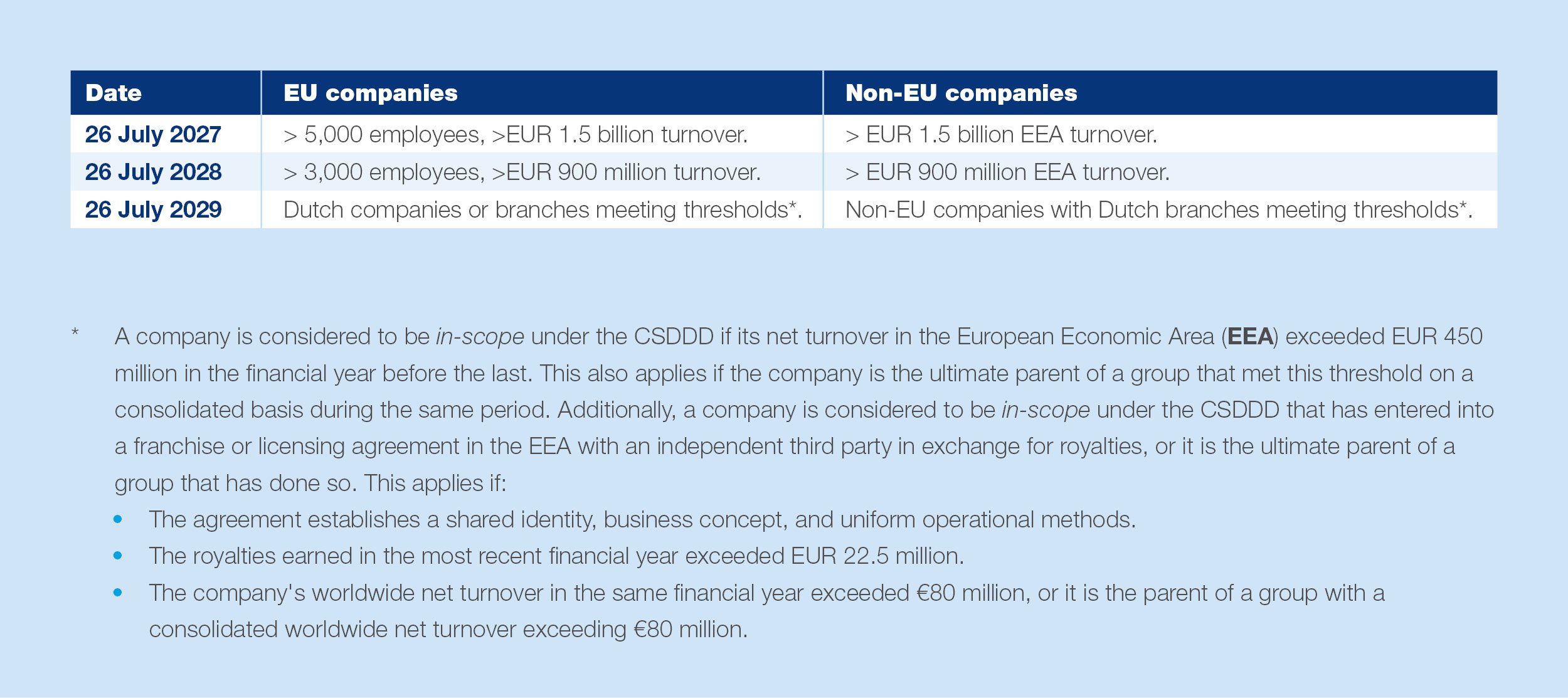

1. Timeline of phased approach under the Proposal

The Proposal included a phased approach (in accordance with the CSDDD):

2. Supervision and Enforcement

According to the Proposal, the Dutch Authority for Consumers and Markets (ACM) will oversee compliance as the Dutch supervisory authority under the CSDDD, including the adequacy of climate chance transition plans and due diligence statements. Enforcement measures include:

- Binding instructions;

- Orders subject to penalties; and

- Administrative fines up to 5% of worldwide consolidated turnover.

The Proposal explicitly does not include criminal penalties for in-scope companies, focusing instead on administrative measures like fines (up to 5% of worldwide consolidated turnover and binding instructions (subject to penalties).

3. Civil liabilities under the CSDDD according to Dutch Law

The CSDDD introduces obligations for in-scope companies regarding sustainability and due diligence, aiming to enhance corporate accountability in relation to ESG issues. The CSDDD establishes broad requirements that in-scope companies must adhere to, creating a more level playing field across the EU.

Under Dutch law, the CSDDD opens up new avenues for civil liability for (in-scope) companies (please be referred to our article on this here and here (in Dutch)). Affected parties must pursue civil claims under Dutch tort law (Article 6:162 of the Dutch Civil Code), which requires proving an unlawful act, attribution, causation, and damages. For the avoidance of doubt: Dutch tort law will not be amended according to the proposal and therefore potential civil liabilities under the CSDDD will be enforced based on existing Dutch tort law.

To support claimants however, the proposal extends the limitation period for civil claims with five years as from the beginning of the day following the day on which the violation of the CSDDD ceased and injured party became aware of both the damages it incurred and the identity of the company responsible for those damages. This extension recognizes the challenges for claimants of uncovering violations (under the CSDDD), particularly in complex, cross-border cases.

Get in touch

Managing the possible liabilities introduced by the CSDDD and the Proposal can become challenging for in-scope companies, especially when interpreted through Dutch civil law. Our firm is closely monitoring the CSDDD, other ESG topics and potential liability and litigation risks in this respect. Therefore, feel free to contact one of our colleagues below for more information about (the implementation of) the CSDDD or ESG litigation in the Netherlands.