Please download the full version of our tax update or read the online version below.

The future tax landscape

The role of taxation in European tax policy becomes more important

The EU’s ambitious tax agenda received a reality check over the past year, which was a year of substantial organisational changes in the EU. The European elections in June 2024 resulted in a European Parliament that, although retaining its pro-EU majority, is more fragmented across the political spectrum than before. Over the past year, the EU’s top political priorities seem to have shifted towards boosting competitiveness and securing Europe’s relevance on the global stage. Draghi's report on the “Future of European competitiveness”, published in September 2024, is noteworthy in this respect.

The new EU Commissioner for taxation, Wopke Hoekstra, will face the challenge of balancing the EU’s ambitious tax agenda with the unanimity requirement in the Council of the EU. We have not seen material developments in 2024 regarding many of the tax proposals released in previous years, such as Unshell, Transfer Pricing, Business in Europe: Framework for Income Taxation (“BEFIT”) and Home Office Taxation (“HOT”). In addition to tracking progress, we are curious to see whether the European Commission has the political ambition to withdraw tax proposals and develop new ones. We may furthermore see discussions on whether the win of the European Commission in the Apple State aid case will lead to new investigations of tax rulings.

Another major political battle on the horizon is the EU’s next long-term budget, for which negotiations are expected to start in 2025. The Commission wants an EU budget that is policy-focused, easy to access and flexible. Moreover, in 2028 the repayments of the EU’s economic recovery fund (“Next Generation EU”) are scheduled to start, and such repayments would come directly from the EU’s own budget. This means that proposals for new own resources for the EU will be a hot topic in 2025. So far, EU Member States have not made progress on the 2023 package of proposals for new EU own resources. It is almost certain that, either behind closed doors or in the public debate, the question will be raised which role taxation could play in contributing to the EU’s investment capacities and climate ambitions and in repaying the EU’s debts.

Finally, the recent election of Donald Trump as president of the United States could be an impactful moment for the success of the Pillar One and Pillar Two projects of the OECD. If the Pillar One project would not advance, the European Commission may consider proposing a digital services tax (mindful of the proposed directive released in 2018).

In conclusion, 2025 promises to be a very interesting year for taxation. We will continue monitoring these developments for you.

EU and international developments

The year 2024 has been marked by significant developments in the field of EU tax law. Central to these developments have been not only the ongoing implementation of the Pillar Two Directive by several Member States, but also the legal action recently filed before the Belgian Constitutional Court on the incompatibility of the Undertaxed Profit Rule (“UTPR”) with the Belgian Constitution and EU law and the DAC9 proposal recently tabled by the EU Commission for reporting and exchanging information on Pillar Two.

Beyond Pillar Two developments, 2024 has seen substantial progress on other EU legislative proposals focused on modernising and strengthening the EU tax framework. Notable among these is the FASTER proposal, which will introduce a unified framework for withholding tax relief procedures for dividends and interest on publicly traded instruments. Similarly, the VAT in the Digital Age (“ViDA”) package which was recently agreed upon by ECOFIN, aims to update VAT rules for digital reporting, single VAT registration and the platform economy. Another initiative that saw progress during 2024 is the Transfer Pricing proposal, which seeks to harmonise key transfer pricing principles across the EU.

Additionally, 2024 has become a critical year for MNEs to comply with transitional rules under legislation already in force, such as the Carbon Border Adjustment Mechanism (“CBAM”). With the CBAM’s transitional period ending in 2025, importers of covered products need to prepare for substantial adjustments taking effect as of January 1, 2026.

Alongside these initiatives, several other legislative proposals are still on the table and will be pushed forward by the Commission in 2025 according to EU Commissioner Hoekstra. These include the Unshell proposal, aimed at tackling tax avoidance through shell companies, and the EU’s new Own Resources framework, which seeks to secure sustainable funding for the EU budget. Other proposals that will get renewed attention are the Business in Europe: Framework for Income Taxation (“BEFIT”), designed to harmonise corporate tax rules across Member States, the Head Office Tax System (“HOT”), which seeks to simplify tax rules for SMEs in early expansion stages, and the Energy Tax Directive (“ETD”), which aims to align energy taxation with EU climate goals.

Additionally, there are several proposals which are not expected to progress in 2025 but are worth keeping on the radar. These include the SAFE initiative, which complements the Unshell proposal by targeting non-EU shell entities, the DEBRA proposal, which aims to mitigate tax-induced debt bias, and the proposal for the publication of effective corporate tax rates (“ETR”).

The adoption of various EU acts over the past years in tax matters has increasingly impacted taxpayers with presence in our home markets. These EU initiatives may not always be in line with primary EU law, creating for example unjustified or disproportionate restrictions of taxpayers’ rights protected under the EU Treaties, the EU Charter, or general principles of EU law. Taxpayers impacted by such measures should, however, not always need to await a tax claim to undertake action. Proceedings for annulment of EU measures can, under certain conditions, be introduced directly before the General Court shortly after publication of the EU act. Moreover, a challenge may be brought before a constitutional court of a Member State directly against the national measure transposing the act, shortly after publication of the transposing national law. The latter procedural path has recently been relied upon to challenge the legality of certain aspects of the EU Pillar Two Directive and the national law transposing the Pillar Two Directive.

Our experts within Loyens & Loeff have extensive expertise in EU (tax) litigation and can assist MNEs in the abovementioned procedures.

The following sections provide a closer look at the Belgian Constitutional Court case and the state of play of the various Commission proposals as well as some other EU and international tax developments.

Will the Undertaxed Profit Rule of Pillar Two survive and if so, in what format?

On 27 June 2024, a petition was filed by a US organisation with the Belgian Constitutional Court to request annulment of Pillar Two’s Undertaxed Profit Rule (“UTPR”) implemented in Belgium via the law of 19 December 2023. In the meantime, other US organisations joined the lawsuit as intervenors.

The main claims of the plaintiff in this case are that the UTPR violates the Belgian Constitution, the European Convention of Human Rights, and the Charter of Fundamental Rights of the European Union for the following reasons:

- The Top-up Tax under the UTPR is levied on group entities that do not have an ownership interest in, and thus cannot control, the low-taxed entity, which leads to the payment of taxes on profits that they do not realise and will never receive. The UTPR is also not limited to the direct or indirect ownership interest held by the group in the low-taxed entity. A Belgian entity can, thus, become liable for a Top-up Tax which may prevent this entity from attaining a reasonable profit and may even threaten the existence of said entity, without a correction mechanism being available, thereby violating the right to property.

- Since a Belgian entity can become liable to a Top-up Tax on profits realised by other legal entities over which it has no control, this entity will not be able to freely use the economic, technical, and financial resources available to it. Moreover, since the entity’s financial position is not considered, the Top-up Tax may exceed the Belgian entity’s profits which may adversely affect its competitive position, creditworthiness and even its viability. For all these reasons, it is argued that the UTPR violates the right to conduct a business and the general principles of legal certainty.

- The UTPR imposes a tax liability on a Belgian entity for undertaxed profits of other entities without considering the financial capacity of this Belgian entity, thereby treating entities with a different financial capacity in a similar manner, which violates the non-discrimination principle.

- A Belgian entity can become liable for a Top-up Tax on profits realised by another entity located outside of Belgium over which it does not exercise any direct or indirect control, with the result that it will never receive these profits. Since these profits have no real nor reasonable connection with the Belgian entity, the UTPR also violates the principle of territoriality.

Since the UTPR in Belgian law originates from the EU Pillar Two Directive and replicates its provisions, the plaintiff also questions the validity of this directive requesting the referral of the case for preliminary ruling by the Court of Justice of the European Union (“CJEU”).

Next steps

A decision of the Belgian Constitutional Court can be expected in 2025. If the case is referred to the CJEU, a decision will take longer but will impact all Member States. This court case is one of a kind as it could significantly affect the implementation of one of the main rules of Pillar Two within Europe. Thus, developments concerning this court case should be closely followed by MNEs in scope of Pillar Two.

This section provides an overview of several EU legislative measures that have been adopted or are expected to be adopted in the short term, and which should be closely followed by MNEs. These concern, the Carbon Border Adjustment Mechanism, the FASTER proposal, the DAC9 proposal and the VAT in the Digital Age package.

Understanding the Carbon Border Adjustment Mechanism: key changes as of 1 January 2026

It is recommended to act in time to get the status of authorised CBAM declarant

The Carbon Border Adjustment Mechanism (“CBAM”) is an initiative of the EU to address carbon leakage. Carbon leakage takes place when companies relocate their manufacturing processes to countries outside the EU with less strict climate policies. CBAM aims to ensure a level playing field between EU and non-EU manufacturers. This mechanism came into effect on 1 October 2023. During the CBAM transitional period, from 1 October 2023 until 31 December 2025, only reporting obligations are applicable. Thus, during this period, importers (or their indirect customs representatives, such as a logistics service provider) are required to report data on imported products covered by the CBAM such as cement, fertilizers, and aluminum products. This includes data on the emissions that are released during the manufacturing process. At the end of this transitional phase changes to this mechanism will come into effect. The key changes as of 1 January 2026 are as follows:

- As of 1 January 2026, importers of products covered by CBAM will need to have the status of authorised CBAM declarant to import CBAM products into the EU customs territory. If an importer is not established in the EU customs territory, it cannot apply for the status of authorised CBAM declarant and needs to use an indirect customs representative with this status. Importers established in the EU customs territory may choose to use an indirect customs representative with this status. The status of authorised CBAM declarant may be applied for as of 1 January 2025. If this status is not obtained before 1 January 2026, products in scope of CBAM may not be imported. Therefore, it is recommended to act in time.

- As of 1 January 2026, authorised CBAM declarants are required to hand in a number of CBAM certificates based on factors, such as the quantity of imported CBAM products and the number of embedded emissions. One CBAM certificate represents one ton of CO2-equivalent embedded emissions. The price of CBAM certificates is determined by the average weekly auction price of EU ETS allowances.

The FASTER proposal

FASTER promises to bring a significant evolution to the withholding tax relief process for cross-border investments

The European Commission’s proposal for Faster and Safer Relief of Excess Withholding Taxes (“FASTER”) of 19 June 2023 aims to introduce a unified framework for withholding tax (“WHT”) relief procedures for dividends and interest on publicly traded instruments. On 14 May 2024, the Council of the EU reached a political agreement on the FASTER proposal. This proposal is a compromise text after amendments to the original proposal released in 2023. Its core objectives are making WHT relief processes faster and more efficient as well as preventing tax fraud and abuse. The expectation is that, once formally adopted by the Council, Member States will have to implement the FASTER proposal by 31 December 2028 and that the FASTER rules will apply as of 1 January 2030.

Key measures

The key measures of the FASTER proposal include:

- Quick relief systems: Member States must introduce either a relief at source system resulting in withholding the correct amount of WHT or a quick refund system resulting in the refund of excess WHT.

- National registers for Certified Financial Intermediaries (“CFIs”): Large institutions and central securities depositaries, which facilitate WHT relief procedures, will be included in national registers as CFIs. Other entities can register voluntarily.

- Standardised Reporting Obligations: CFIs will report essential information to competent authorities to identify investors, the entitlement to reduced WHT rates and potentially abusive WHT schemes. It is intended to provide tax authorities with visibility of the financial chain and investor’s reclaim eligibility.

- Common EU Digital Tax Residence Certificate (“eTRC”): The eTRC will facilitate the confirmation of investors’ tax residency within the EU and improve the administrative process.

The role of CFIs

CFIs play a pivotal role in FASTER. They will have to implement due diligence procedures to assess investors’ reclaim eligibility, including collecting and verifying beneficial ownership declarations and tax residence declarations.

Anti-abuse and fraud measures

The FASTER proposal incorporates anti-abuse measures aimed at preventing fraud and abuse. Relief requests are excluded from fast-track procedures if these measures apply, for instance in the case of short-term ownership of securities, dividends tied to unsettled financial arrangements, and cases involving non-certified intermediaries.

Takeaways and tips

- Adapting to enhanced due diligence and reporting requirements can be challenging for CFIs and investors. CFIs will face increased administrative burdens and risks, while investors need to adjust to new documentation and verification processes.

- FASTER imposes stringent compliance obligations on financial intermediaries and asset-servicing organisations such as custodian banks. Institutions included in the national registers on a mandatory basis should prepare their compliance strategies.

- Investors should review their WHT refund procedures and ensure their documentation is complete. They should also engage with financial intermediaries about readiness for new systems and stay updated on legislative developments.

The VAT in the Digital Age package

On 8 December 2022, the European Commission published a legislative proposal regarding VAT in the digital age (“ViDA package”). The measures introduced in the ViDA package will impact all businesses and particularly those carrying out cross-border transactions and platform companies.

The ViDA package focuses on improving VAT efficiency, minimising VAT fraud and reducing foreign VAT registration obligations. It consists of three pillars, being (i) digital reporting, (ii) single VAT registration and (iii) VAT treatment of the platform economy.

The new rules under ViDA will introduce mandatory e-invoicing and digital reporting requirements. Taking effect 1 July 2030, e-invoicing will become the default for cross-border B2B supplies of goods and services within the EU. Upon formal adoption of the ViDA package, Member States can choose to impose e-invoicing requirements for domestic transactions without prior EU consent.

To reduce VAT compliance obligations, the idea is that businesses involved in cross-border transactions will only have to maintain a single VAT registration in one Member State. This will be effected through an extension of the scope of One-Stop-Shop schemes and mandatory application of reversed charged mechanisms as of 1 July 2028 and as of 1 July 2027 for the supply of gas, electricity, and heating and cooling systems.

Furthermore, VAT reporting liabilities will be further centered around digital intermediary platforms, thereby distinguishing platforms facilitating supplies of goods and platforms facilitating the provision of services. The VAT liability of platforms for supplies by non-EU suppliers will be extended to capture all supplies of goods taking effect 1 January 2027. In relation to the provision of services, a new VAT liability will be introduced for platforms facilitating short-term accommodation rental for a maximum of 30 nights and passenger transport services by road. The implementation of this liability is optional as of 1 July 2028 and mandatory as of 1 January 2030.

For more details regarding the proposals and their expected entry into force, reference is made to our website post.

Next steps

On 5 November 2024, the Council of the EU finally reached political agreement on an amended version of the ViDA package. The European Parliament will now be re-consulted on the amended ViDA package and subsequently the package will be put up for formal adoption by the Council. The formal adoption which, at this point, seems to be a mere formality, is expected to take place early 2025.

Takeaways and tips

- Businesses need to start amending their invoicing and VAT reporting processes preparing for the changes as of 1 July 2030.

- Businesses will further have to assess whether their foreign VAT registrations are still required after 1 July 2028, and as of 1 July 2027 if they are supplying gas, electricity, and heating and cooling systems.

- Platform companies will have to prepare for the new obligations and requirements applicable to them as of 1 July 2028 and as of 1 January 2030 if their Member State has chosen to extend the introduction of the new rules to that date.

Our VAT advisers can assist clients in anticipating on and preparing for these new rules and obligations.

The DAC9 proposal

On 28 October 2024, the European Commission proposed amending again the Directive on Administrative Cooperation (“DAC”) to facilitate the filing and exchanging of Pillar Two-related information in the EU. This proposal is referred to as "DAC9".

The proposal aims at implementing in a coordinated manner the OECD's GloBE Information Return (“GIR”) into EU law by making it the Top-up Tax Information Return (“TTIR”), as already contemplated by the Pillar Two Directive. By default, each constituent entity of an in-scope group must file a TTIR in the Member State where it is located. However, there is, under conditions, a derogation to the extent that the group’s ultimate parent entity (“UPE”) or a designated entity files the TTIR on behalf of the whole group and the TTIR is subsequently exchanged.

In-scope groups are expected to file their first TTIR by 30 June 2026, as required under the Pillar Two Directive. The relevant tax authorities would have to exchange appropriate information from the TTIR with each other by 31 December 2026 at the latest. However, for Member States that have chosen to defer the entry into force of the IIR and the UTPR by six fiscal years, the first year in which DAC9 would apply, shall be the first year following the end of such election.

The DAC9 proposal furthermore lays down an EU framework to facilitate the exchange of TTIRs between Member States. For the exchange of information with third countries, Member States will have to sign appropriate international agreements with those jurisdictions.

Because of its alignment with the OECD's GIR and the importance of the TTIR for the effective enforcement of the Pillar Two Directive, one could expect the DAC9 proposal to be swiftly adopted during 2025. If adopted by the Council in time and in its current form, DAC9 would generally have to be implemented into national law by 31 December 2025, i.e., six months prior to the first filing deadline of the TTIR for groups in scope of Pillar Two rules.

For more details we refer to our website post.

Takeaways and tips

- In-scope groups should determine which entity and in which Member State they will file their TTIR.

- Data points should be collected sufficiently early to ensure timely filing.

- The TTIR filing obligation does not exclude local top-up tax filing obligations in jurisdictions where an amount of top-up tax is payable.

This section provides an overview of several EU legislative measures that have been proposed but are still under discussion. While there is no certainty on whether these proposals would ultimately be adopted, MNEs and also SMEs should closely follow them as, if adopted, they would have a strong impact on them. These include the TP proposal, the Unshell proposal, the proposal for new EU own resources, the BEFIT proposal, the HOT proposal, and the revision of the Energy Taxation Directive.

The proposal to harmonise transfer pricing principles across the EU

On 12 September 2023, the European Commission released a proposal for a Council Directive that seeks to harmonise key transfer pricing principles across the EU (the “TP proposal”). To ensure a common application and interpretation of the arm’s length principle ("ALP”), the TP proposal prescribes Member States to implement the 2022 version of the OECD Transfer Pricing Guidelines in the Member States’ domestic legislation. In addition, it includes specific sections on (i) the definition of associated enterprises, (ii) downward adjustments, (iii) application of the most appropriate method, (iv) use of the interquartile range, and (v) transfer pricing documentation. The TP proposal also enables the European Commission to propose common binding rules and safe harbours for specific transactions.

In its current form the TP proposal has attracted critical reactions from Member States. The main points of criticism refer to the potential creation of a double transfer pricing standard, differences in the definition of associated enterprises between Member States, and the loss of flexibility in negotiating and applying the OECD Transfer Pricing Guidelines. On such a basis, it is feasible that the TP proposal will be replaced by a non-binding Joint Transfer Pricing Forum (“JTPF”), similar to the one that existed until 2019. Alternatively, a combination of a Council Directive supplemented by a JTPF has also been suggested. Allegedly, because of EU law obstacles, it has been recommended that the European Commission withdraws the TP proposal to allow discussions on the JTPF to move forward. However, the European Commission has not yet indicated its decision on this matter, nor has it explicitly mentioned this initiative as a “focus” area.

Takeaways and tips

Further harmonisation of transfer pricing principles across the EU may be beneficial for MNEs active in the EU in the long term. However, this may also introduce stricter rules on transfer pricing and increase compliance. Therefore, it is recommended that MNEs active in the EU monitor further developments concerning the TP proposal.

The Unshell proposal

What is next for the proposal directive combatting misuse of entities with no or minimal substance?

On 22 December 2021, the European Commission first presented a proposal for a directive introducing a legal framework for Member States to combat the use and misuse of shell entities for improper tax purposes (“Unshell proposal”). The Unshell proposal is intended to counter situations where taxpayers misuse EU entities that have no or minimal substance and that do not perform actual economic activities, i.e., a “shell” entity.

For tax purposes, the Unshell proposal would introduce new reporting obligations, information exchange between Member States and possibly a denial of certain tax benefits. Whether a company classifies as a shell entity is to be assessed based on specific carve-outs, gateways, and substance indicators. For detailed information on the Unshell proposal, we refer to our brochure of May 2022.

Since the publication of the Unshell proposal in December 2021, Member States have not yet managed to reach unanimous consent on a final version of the directive. Various Member States, during their respective EU presidencies, have discussed alternative frameworks to the first draft proposal, with the aim to reach compromise on concerns raised by Member States. In this regard, we understand from various sources that there is a divide between Member States favouring the idea to limit the directive to an exchange of information on shell entities versus Member States feeling strongly about including tax consequences in the directive.

A way forward on the proposal was tabled in the summer of 2024, which would have introduced a self-assessment hallmark system instead of the economic substance test and would have limited reporting obligations for entities that present a high risk of being used in abusive tax schemes based on the hallmarks. The proposed approach also did not include common tax consequences but instead created an obligation for Member States to use exchanged information to undertake administrative measures. This new approach, however, was dismissed by the Member States, being deemed as too complex.

Next steps

The ECOFIN Report published on 24 June 2024, contains a section on the Unshell proposal, reading that most delegations have supported the objectives of the proposal, but were of the view that further important technical work was necessary before an agreement could be feasible. A political decision from the European Commission on whether to proceed with the proposal or withdraw and prepare a new initiative, which could potentially take several years, will most likely be taken in the course of 2025 under the guidance of EU Commissioner Hoekstra. In a reply to questions submitted by the European Parliament and published on 23 October 2024, Hoekstra stated that the Commission continues its wider efforts to address aggressive tax planning, for example through the Unshell proposal. In addition, on 7 November 2024, he noted that he will be engaging with the EU finance ministers to discuss what is needed to unlock the Unshell proposal and push it forward. Further updates thereon are therefore to be expected in due course.

Takeaways and tips

- MNEs should continue to monitor the relevant developments in relation to the Unshell proposal, being mindful of its potential impact.

- Considering the increased focus in the international tax landscape on “genuine” substance, MNEs should in any case ensure that their current structure is substance-proof, and the business set-up is aligned therewith.

- Our tax professionals have the knowledge and practical experience to assist MNEs in this regard, providing advice from an EU perspective as well as from a Dutch, Belgian, Luxembourg and Swiss tax perspective.

The proposal for new EU own resources

On 22 December 2021, the EU Commission tabled a proposal for new EU own resources which aims to create new sources of revenues for the EU budget. This 2021 proposal contained three sources of revenue based on the EU emissions trading scheme (“ETS”), the carbon border adjustment mechanism (“CBAM”), and the proceeds of the OECD's Pillar One. On 20 June 2023, the Commission put forward an adjusted package for EU own resources, amending and complementing its previous proposal. According to this new package, the three new EU own resources would consist of (i) 30% of revenues from the auctioning of ETS allowances, (ii) 75% of revenues from the sale of CBAM certificates, and (iii) a temporary, national contribution based on national accounts statistics prepared under the European system of accounts, which contribution would be calculated based on 0.5% of the sum of gross operating surplus recorded for the sectors of non-financial and financial corporations in such national accounts.

The Commission noted that the latter statistical contribution will not be a tax on companies, nor will it increase companies’ compliance costs. This contribution will be replaced by the future establishment of an EU own resource based on an underlying tax, i.e., a contribution arising from either BEFIT or an EU measure implementing Pillar One's Amount A. At this point, since the implementation of the latter measure has stagnated and seems to have failed at the global level, it is not expected that this item will become a new EU own resource, at least not in its current form.

Following the favourable vote of the European Parliament on the adjusted package for EU own resources in November 2023, this file has not seen much progress during 2024. However, from a hearing that took place on 7 November 2024, it can be derived that the European Commission intends to push forward the current package of EU own resources in 2025.

The BEFIT proposal

On 12 September 2023, the European Commission proposed a Council Directive on “Business in Europe: Framework for Income Taxation (“BEFIT”)”. This proposal contains a common corporate income tax framework for groups active in the EU and builds on the OECD/G20 Inclusive Framework's Pillar Two.

Apart from a supportive non-binding opinion issued by the European Economic and Social Committee (“EESC”) in April 2024, the BEFIT proposal has not seen noteworthy progress during 2024. Although Member States have welcomed the BEFIT objectives, many of them have voiced their concerns regarding the BEFIT's compatibility with the EU principle of subsidiarity and its interaction with national corporate tax rules, Pillar Two rules, and anti-abuse measures. Thus, further technical work and negotiations will be necessary before Member States can reach a political agreement on the BEFIT proposal. On 7 November 2024, EU Commissioner Hoekstra noted that advancing the negotiations on BEFIT is one of the Commission's priorities. Thus, it is expected that further discussions on this file will occur during 2025.

The HOT proposal

Published on 12 September 2023, the proposal for a directive on a Head Office Tax System for small and medium-sized enterprises (“SMEs”) (“HOT proposal”) aims at simplifying tax rules for SMEs during their early stages of expansion. The HOT proposal would allow certain EU-based standalone SMEs that operate in other Member States through permanent establishments (“PEs”), to determine the taxable results of such PEs according to the rules of the Member State of their head office. The taxable results of such PEs would nevertheless remain subject to the tax rate of the Member State in which they are located. The HOT proposal is designed as a complementary measure to BEFIT, which is primarily aimed at large groups operating across the EU.

During 2024, progress was achieved regarding the HOT proposal. In January 2024, the EESC adopted a non-binding supportive opinion on this initiative. Furthermore, on 10 April 2024, the European Parliament also adopted a supportive non-binding report on the HOT proposal, although recommending clarifications about its rationale and substantial changes regarding its scope. The latter by extending it to companies that operate in other Member States through not more than two subsidiaries.

In general, Member States have raised concerns about potential challenges raised by the HOT proposal, which are linked to its administrative challenges and its impact on the tax revenues and the tax sovereignty of Member States. According to Commissioner Hoekstra advancing the negotiations on HOT is one of the Commission's top priorities to help SMEs having a cross-border business in the EU. Further work on this file is expected in 2025.

Revision of the Energy Taxation Directive (“ETD”)

On 14 July 2021, the European Commission submitted a proposal for a revision of the Energy Taxation Directive (“ETD proposal”).

The ETD contains minimum excise duty rates for the taxation of electricity, as well as energy products such as motor fuel and heating fuel. The current ETD, however, does not reflect the EU’s (renewed) climate policy and ambitions. The ETD proposal aims to align the taxation of energy products with the EU's energy and climate change objectives and introduces a new structure of tax rates based on energy content and environmental performance of the fuels and electricity. Furthermore, the proposal broadens the taxable base by including more products in its scope and by removing some of the current exemptions and reductions.

Since initially tabled in 2021, the Council of the EU has advanced the negotiations about the ETD proposal, which falls under the EU special legislative procedure. Being one of the priorities on the agenda of the Commission, it is expected that the ETD proposal will continue to be negotiated during 2025.

Recently, the new EU Commissioner Hoekstra informed the European Parliament that the Commission will continue to work with the Council to progress to a compromise on the ETD proposal, while aiming to safeguard a high level of ambition. He mentioned that he will reflect on the recommendations of the Draghi report, including solutions based on cooperation between Member States to strengthen the internal market and to ensure that taxes, charges, and levies do not have a negative impact on energy prices and on the competitiveness of EU industry, while supporting clean transition objectives.

Takeaways and tips

During 2025, MNEs and SMEs should follow the negotiations and discussions on the TP proposal, the Unshell proposal, the proposal for new EU own resources, the BEFIT proposal and the HOT proposal and the revision of the Energy Taxation Directive. which, at this point, are the ones which will most probably move forward and have the greatest impact for them.

This section provides an overview of EU legislative measures that have been announced or proposed but which have been temporarily put on hold. While there is no certainty on whether the negotiations of these proposals would restart, MNEs should keep them on their radar. These include the SAFE proposal, the DEBRA proposal, and the proposal for the publication of effective corporate tax rates.

The SAFE proposal

On 6 July 2022, the Commission launched a public consultation on a proposal to Secure the Activity Framework of Enablers (“SAFE”). This initiative aims to tackle the role that enablers can play in facilitating arrangements or schemes that lead to tax evasion or aggressive tax planning, i.e., to prevent enablers from setting up structures with non-EU shell entities and eroding the tax bases of Member States. The SAFE proposal intends to complement the Unshell proposal as described under the heading 'Other legislative proposals still under discussion’.

Since its public consultation, the SAFE file has not progressed, and the Commission has not yet announced when the SAFE proposal will be presented. However, it was recognised that no progress should be expected on this file before an agreement is reached on the Unshell Directive.

The DEBRA proposal

On 11 May 2022, the European Commission announced the proposal for a directive on debt-equity bias reduction allowance (DEBRA), which aims to create a level playing field for debt and equity from a tax perspective. In a nutshell, this initiative aims to remove taxation as a factor that can influence companies' commercial decisions. Thereto, the proposal includes both a notional deduction on growth in equity and an additional limitation on interest deduction for corporate income tax purposes.

Due to the many interlinkages between DEBRA and other corporate tax files, the examination of this proposal was suspended in December 2022. No new developments in this regard occurred in 2024 nor are expected in 2025.

The proposal for the publication of effective corporate tax rates (“ETR”)

In May 2021, the EU Commission announced that it would put forward a new proposal for the annual publication of the effective corporate tax rate of certain large companies with operations in the EU (“ETR proposal”), using the methodology agreed upon in the Pillar Two Directive.

The file regarding the ETR proposal did not see any progress during 2023 and 2024, and the Commission has not announced whether or when this proposal will finally be tabled.

Takeaways and tips

- It is important for MNEs to continue following the developments regarding EU pending proposals and to be mindful of their potential impact and implications.

- To stay on top of all developments regarding these and other pending EU proposals that are relevant to you and your organisation, please subscribe to our EU Tax Law Alert.

EU State aid: what to expect after Apple?

In September 2024, the CJEU sided with the European Commission against Apple and Ireland in a landmark judgment. This outcome can be expected to boost the European Commission after a string of significant court losses in other cases concerning tax rulings.

Whilst the reasoning is largely case-specific and heavily debated on the merits, the judgment brings lessons also for other taxpayers, in particular:

- The role of OECD guidance in applying the arm’s length principle: contrary to its stance in the Fiat and Amazon cases, in which it virtually fully set aside the use of the OECD transfer pricing guidelines, the CJEU seems to accept the use of the Authorised OECD Approach to allocate profits between a head office and the Irish permanent establishment even if it was not directly implemented in Irish law. The CJEU argues that this approach matched the content of Irish law, which required taxing profits allocated to the Irish branches of the two Apple companies.

- The need to carefully document decision-making and ensure that functions allocated to specific entities or parts of entities are actually performed in a demonstrable way. In the Apple case, board minutes did not reflect the role of the head office managers in respect of the valuable intellectual property.

- The need to properly distinguish the roles played by group employees for different entities of the group, in particular if they are both employees of the group headquarters and managers of specific subsidiaries.

The judgment has raised questions whether the CJEU was more generally departing from its approach in the prior Fiat, Amazon and ENGIE cases. This should in principle not be the case, as a few days after the Apple judgment, the CJEU ruled against the European Commission in the UK CFC case, finding that the Commission had wrongly defined the reference framework.

As such, whilst the European Commission may feel encouraged to continue its existing investigations in tax rulings, some of which (Nike, Inter IKEA, Huhtamaki) have been pending for many years without a final decision, and open new ones, it will nevertheless need to adjust its approach to mitigate the risk of further losses in court. In particular, the definition of the reference framework against which to test the existence of a selective advantage seems to be in most cases the Achilles’ heel of the European Commission. Further, it remains to be seen whether these investigations will remain a priority of the new European Commission, which needs to address a range of pressing political challenges.

The contribution of tax governance in ESG strategy

Tax governance and ESG are closely linked as tax is often viewed as a measure of a company's financial contribution to the communities in which it operates. Also, governments offer grants and tax incentives for sustainable investments. Integrating these into a company’s strategy can fund decarbonisation, green technologies, and renewable energy projects.

ESG benchmarks, frameworks and certification are on the rise with organisations like B Lab and The B Team leading the way. The B Lab’s certified B Corporations and the B Team consider aspects of taxation relevant from an ESG perspective and the number of B-corps is steadily increasing. The tax standard of the Global Reporting Initiative (“GRI”) is becoming increasingly adapted on a voluntary basis because companies take the opportunity to engage with stakeholders by disclosing their approach to tax, their tax governance and their tax risk control and management.

Tax governance in light of reporting obligations

With the introduction of the Corporate Sustainability Reporting Directive (“CSRD”) and the EU directive on public Country-by-Country Reporting (“Public CbC Reporting”), companies will face increased demands for transparency and accountability.

Public CbC Reporting requires large multinational corporations to publicly disclose their corporate income tax payments on a per-country basis. This Public CbC Reporting will become a vital part of corporate communication, offering stakeholders transparent and comparable insights into tax policies, impacts and associated risks. Multinational groups, including those not publicly listed, with consolidated revenues over €750 million, must comply with these requirements for financial years starting on or after 22 June 2024. For most groups this means that these requirements should be met for the financial year 2025.

The CSRD, effective as of 1 January 2024for the largest listed companies, will gradually extend to smaller listed entities and large non-listed entities. The CSRD covers a wide range of sustainability issues, including ESG aspects, as outlined by the European Sustainability Reporting Standards. Within this framework, tax governance will be a crucial component of ESG reporting. The CSRD, like other sustainability reporting frameworks, includes tax elements that need to be considered when discussing aspects such as materiality and a company’s strategies.

Takeaways and tips

- Integrating tax into a company’s ESG strategy is important as effective tax management can add substantial value to a firm’s sustainability ambitions.

- Embedding tax into your sustainability strategy builds trust and reinforces governance.

- Good tax governance is necessary to comply with increasing reporting obligations.

It is recommended for MNEs active in the EU to keep monitoring their DAC6 position

On 29 July 2024, the Court of Justice of the European Union (“CJEU”) delivered its judgment in the case Belgian Association of Tax Lawyers and Others v Premier ministre/Eerste Minister (Case C-623/22). The case concerns the compatibility of the mandatory reporting regime for cross-border arrangements introduced under DAC6, with various EU law principles, including equality, non-discrimination, legality in criminal matters, legal certainty, and the right to respect for private life. In its judgment, the CJEU upheld the validity of DAC6 in line with Advocate General Emiliou's Opinion.

The judgment by the CJEU does not clarify the ambiguities related to DAC6. As a result, questions on the scope of different DAC6 concepts, such as “arrangement”, “cross-border”, the different hallmarks, the “main benefit test” and the starting point for the 30-day reporting term, to determine the reporting obligations will persist.

In May 2024, the European Commission launched a public consultation on the evaluation of Directive 2011/16/EU on administrative cooperation in the field of direct taxation (“DAC”), including DAC6. Given the abovementioned persisting ambiguities related to DAC6 and the differences in implementation and interpretation by the Member States, a more centralised guidance on the interpretation of DAC6 at EU level would be desired for MNEs and their advisers.

Takeaways and tips

It is important for MNEs to continue following the developments regarding the different DAC6 concepts at EU level and in the different Member States. Furthermore, it is recommended that MNEs discuss and streamline with their advisers at an early stage whether a potential reporting obligation exists in a Member State, and if so, the information that will be filed.

Looking at the global tax landscape, we point out the worldwide implementation of the OECD’s Two-Pillar solution. It still remains uncertain whether the expected multilateral convention on Amount A of Pillar One, once finalised and opened for signature, will also be signed and ratified by the US. The ratification (by the US) is needed for its entry into force. If no agreement will be reached at a global level, more countries might start implementing digital services taxes.

Also Pillar Two remains a challenge for many multinationals. There are many questions that for the moment remain unsolved. Further, although European countries have implemented the Pillar Two rules or expressed their intention to do so, not many countries outside Europe have implemented these rules. This is for instance also the case for China and India which seem to await whether the US will implement the Two-Pillar solution.

Other important global tax developments MNEs should follow during 2025 include the work on the OECD Pillar Two's Subject to Tax Rule (“STTR”) and the negotiations ongoing at the United Nations (“UN”) regarding its Framework Convention for International Tax Cooperation.

OECD Pillar One / Amount B

Amount B of Pillar One is an optional simplified and streamlined approach for the application of an approximation of the arm’s length principle to baseline marketing and distribution activities (“BMDA”). Amount B provides a pricing framework which includes a 3-step process to determine a return on sales (“RoS”) for in-scope wholesale distribution of goods. Jurisdictions can choose to apply Amount B for fiscal years beginning on or after 1 January 2025. There is no minimum revenue threshold for the application of Amount B. We expect that our home markets would accept the outcome of Amount B when applied in other jurisdictions.

Overview of Amount B

On 19 February 2024, the OECD Inclusive Framework (“IF”) published the Pillar One - Amount B Report (the “Report”), which is incorporated as an annex to Chapter IV of the OECD Transfer Pricing Guidelines. Based on the Report, jurisdictions can (i) authorise tested parties to optionally apply Amount B, or (ii) require the application of Amount B as mandatory for in-scope BMDA. The members of the IF have extended their political commitment to respect the outcomes of the application of Amount B by so-called Covered Jurisdictions. On 17 June 2024, the IF published the definition and current list of Covered Jurisdictions that will be updated every five years. See our website post for details on the definition and list.

To be eligible for Amount B, transactions involving the wholesale distribution of goods must meet scoping criteria. See our website post for further details. The arm’s length RoS remuneration for BMDA of a taxpayer under Amount B can be determined through a pricing matrix by assessing the (i) net operating asset intensity, (ii) operating expense intensity, and (iii) industry group. This remuneration will be subject to (potential) profitability adjustments, being (i) the operating expense cross-check, and (ii) the data availability mechanism. See our website post for details on the application hereof.

Taxpayers that choose to apply Amount B should include the relevant information to assess whether the application criteria are met in their local file or any other relevant transfer pricing documentation. Bilateral or multilateral advance pricing arrangements and mutual agreement procedures obtained prior to the implementation of Amount B would continue to be valid in relation to covered qualifying transactions.

Takeaways and tips

- Jurisdictions can choose to apply Amount B for fiscal years beginning on or after 1 January 2025. Taxpayers should therefore monitor implementation in the jurisdictions in which they are active, especially if those are on the list of Covered Jurisdictions.

- Taxpayers can already assess whether (i) their wholesale distribution activities are in scope for the application of Amount B, and (ii) their remunerations align with the returns from the pricing matrix, considering any applicable profitability adjustments. In case of alignment, we recommend to already include this in your transfer pricing documentation to mitigate the risk of challenges. If there would be differences with Amount B, we recommend further assessing and, if possible, substantiating these differences in your transfer pricing documentation.

- We recommend to already account for Amount B in transfer pricing reports for marketing and distribution activities, which in many countries could act as a safe harbour, to allow taxpayers to benefit from this development as soon as local implementations begin in 2025.

- Due to the expected broader impact of Amount B on the general pricing of marketing and distribution activities, taxpayers may consider the potential impact of this development on their transfer pricing policies and assess remuneration differences with the Amount B pricing matrix. Alignment of activities with Amount B to benefit from this potential safe harbour could also be considered within such assessment.

Pillar Two’s Subject to Tax Rule and its multilateral implementation

The Subject to Tax Rule (“STTR") is a treaty-based measure included in the Pillar Two tax reform which allows a source state that has ceded taxing rights on certain mobile intragroup payments under the normal allocation rules of a double tax treaty (“DTT”), to reclaim taxing rights in certain circumstances where the intragroup payment is taxed at an (adjusted) nominal rate of less than 9%.

For more information on the STTR, please see our website post on this topic.

The implementation of the STTR requires the introduction of amendments to DTTs, which can be achieved through either bilateral negotiations or a multilateral instrument (“MLI”). Relying on the latter option, the OECD opened for signature the Multilateral Convention to facilitate the implementation of Pillar Two’s subject to tax rule (“STTR MLI”) on 2 October 2023, which was followed by a signing ceremony on 19 September 2024. The ceremony was attended by 57 members of the Inclusive Framework (“IF”) and the STTR MLI was signed by 9 jurisdictions, being Barbados, Belize, Benin, Cabo Verde, Democratic Republic of Congo, Indonesia, Romania, San Marino, and Turkey, with 10 more indicating their intention to sign, among which Belgium.

The practical implications of the signature of the STTR MLI are still not clear and depend, among other things, on national ratification processes and on whether more jurisdictions sign and ratify this multilateral instrument. In any event, the limited adoption of the STTR MLI suggests that developing countries are not entirely convinced of the benefits of this measure. Despite the political commitment made by members of the IF that apply nominal tax rates below 9% to implement the STTR into their DTTs with IF's developing countries when requested to do so, it is important to note that there is no binding legal obligation for developed countries to adopt the STTR. This raises further questions and speculations on the future of this measure, which would depend on whether developed countries adhere to their political commitment or not.

Takeaways and tips

In any event, MNEs should closely monitor the jurisdictions signing the STTR MLI, the positions they take and the national ratification processes, as all these factors will determine the DTTs that are going to be impacted by this rule.

The UN Framework Convention for International Tax Cooperation

With the aim of dislodging the OECD and developed countries from their global tax leadership role, the United Nations (“UN”) is currently working on the creation of a new Framework Convention on International Tax Cooperation (“FC”), which is meant to strengthen international tax cooperation and make it more inclusive and effective.

On 16 August 2024, an ad hoc member-state-led intergovernmental committee voted in favour of the final draft of the Terms of Reference (“TOR”) for this new UN FC, which would basically consist of some general guidelines to negotiate said multilateral convention. In total, 110 countries, mostly of the African, Asian, and Latin American continents, voted in favour of this final draft TOR, while 8 countries (including the US and seven of its allies) voted against it and 44 countries (including EU Member States) abstained. The final draft TOR will be submitted to a vote by the UN General Assembly at the end of 2024 and it seems likely that this vote will closely resemble the committee vote.

Takeaways and tips

Based on the incipient nature of the UN negotiations, the still overly broad and vague wording of the TOR and the timeline set forth for the development of the FC, we consider that these developments will not have concrete and/or practical consequences for MNEs in the short term. Nevertheless, the discussions at the UN level should be closely followed during 2025 since important decisions about the FC and its early protocols would most likely be made during this period. Moreover, MNEs should keep these developments on their radar because, in the long term, they could potentially lead to the adoption of new UN-based taxation rules by developing countries, further regulatory fragmentation and a duplication of existing international tax processes, rules and standards.

The Netherlands – Domestic developments

Tax plans 2025

On 17 September 2024, Budget Day 2024, the Dutch Ministry of Finance submitted the 2025 Dutch Budget containing various tax proposals for the year 2025 (“Tax Plans 2025”) to parliament. For a brief overview of the Tax Plans 2025 we refer to our tax flash. The government promoted a solid and predictable tax policy in order to preserve a stable economy. The proposals inter alia relate to the earnings stripping rules, a new workable group definition in the Withholding Tax Act 2021 (“WTA 2021”), see under the headings ‘Earnings stripping rule' and 'The introduction of a new group definition in the Withholding Tax Act 2021', and a favorable amendment to the debt relief exemption in case of tax losses.

In addition, it was proposed to incorporate the latest OECD Pillar Two Guidance in the Minimum Tax Act 2024, and to lay down rules on the interaction of the Pillar Two rules with the so-called “subject-to-tax-rules” in the Corporate Income Tax Act (“CITA").

Other, earlier adopted, changes related to the new classification rules for Dutch limited partnerships (commanditaire vennootschappen), comparable foreign entities and Dutch funds of joint account (fondsen voor gemene rekening), applicable as of 1 January 2025. Under the heading 'Entity classification rules' these proposals and measures will be discussed in more detail.

Finally, some tax-increasing measures that were adopted by parliament during the government-free period last year, will be reversed or relieved. In that respect it is proposed that:

- The 30% expat regulations will not be reduced to 10% but only to 27%.

- The abolishment of the tax-free share buyback facility for listed entities as of 2025 will be reversed, meaning that the facility will remain available in its current form.

- The top personal income tax rate in box 2 regarding taxation of substantial interests will be lowered to the 2023 rate, thus from 33% in 2024 to 31% as of 1 January 2025.

Observations and entry into force

On 14 November 2024, the Dutch Second Chamber of Parliament adopted the Tax Plans 2025. During the parliamentary process, some changes to the Tax Plans 2025 were made by the Ministry of Finance and members of parliament proposed various amendments and motions, some of which were also adopted. These amendments, inter alia, resulted in the withdrawal of the following earlier proposed measures:

- eliminating the EUR 1 million threshold in the earnings stripping rule for real estate investment companies, which is financed by lowering the fiscal EBITDA cap to 24.5%; and

- disallowing the tax deductibility of charitable donations by corporates.

Moreover, it was agreed that alternative measures will be presented in spring 2025 to reverse the increase of the VAT rate for certain activities, i.e., culture, sports and media.

For more details we refer to our website post.

The reason that quite some changes were made to the original proposed Tax Plans 2025 is a result of the fact that the coalition government has no majority position in the First Chamber and had to make concessions. It is now expected that the First Chamber will vote in favour of the Tax Plans in December. If voted in by the First Chamber, the tax measures described below will enter into force as of 2025 or, as the case may be, 2026.

Earnings stripping rule

The earnings stripping rule is a general interest deduction limitation rule that applies to third party interest as well as related party interest. The rule limits the deductibility of the net interest expenses consisting of the balance of interest costs and interest income including foreign exchange results and costs on loans or agreements comparable thereto. Under this rule, the deduction of a taxpayer’s net “borrowing costs” is limited to the highest of (i) 20% of the fiscal EBITDA, and (ii) a threshold of EUR 1 million.

On Budget Day 2024, the Dutch government proposed to increase the percentage under (i) above from 20% to 25% of the fiscal EBITDA as of 1 January 2025. In addition, the Dutch government proposed to exclude the EUR 1 million threshold of the earnings stripping rule under (ii) above for real estate companies with real estate leased to third parties as of 1 January 2025.

The proposed exclusion of the EUR 1 million threshold for real estate companies with real estate leased to third parties was heavily criticised, as it would negatively impact investors, housing associations and the Dutch housing market. As a result, an amendment was filed and adopted by the Second Chamber of Parliament resulting in the withdrawal of the exclusion of the EUR 1 million threshold for real estate companies. This amendment is funded by increasing the percentage of the fiscal EBITDA under (i) to 24.5% instead of 25%.

Consequently, as of 1 January 2025 the deduction of net “borrowing costs” of each taxpayer is expected to be limited to the highest of (i) 24.5% of the fiscal EBITDA, and (ii) a threshold of EUR 1 million.

Dutch interest deduction limitation of article 10a CITA

The Netherlands has a specific interest deduction limitation that restricts the deduction of intragroup financing costs in certain “abusive” situations. According to article 10a of the Corporate Income Tax Act (“CITA”), interest on related party debt is in principle non-deductible if, inter alia, the loan is taken up to finance the acquisition or equity funding of a subsidiary or a dividend distribution by a subsidiary. If a loan is within scope of article 10a CITA, the interest can still be deducted if the taxpayer demonstrates that there were business reasons for both the transaction and the loan, or if the interest is subject to a (corporate) income tax which is reasonable according to Dutch standards.

On 4 October 2024, the Court of Justice of the European Union (“CJEU”) ruled that the Dutch interest deduction limitation rule of Article 10a CITA is not in breach of EU law, as it pursues the legitimate objective of combatting tax fraud and tax evasion.

Takeaways and tips

It is recommended to reassess earlier positions taken based on the CJEU’s judgment in Lexel.

Transaction costs / participation exemption

Both internal and external costs incurred by a taxpayer in connection with the acquisition or disposal of shares in a subsidiary to which the participation exemption applies, are not deductible for Dutch corporate income tax purposes. Costs are considered incurred in connection with a transaction in case there is a direct causal link between those costs and the transaction. This link is present if the costs would not have been incurred absent the transaction. In a judgement dated 22 December 2023, the Dutch Supreme Court clarified that the required direct causal link is present in case the costs are, according to objective standards, useful or necessary to achieve or complete the transaction. A direct causal link is absent in case such costs, although they would not have been incurred if the transaction had not taken place, cannot otherwise contribute in any way to realising the transaction.

Knowledge document Dutch tax authorities

On 1 February 2024, the Dutch tax authorities published a knowledge document regarding their view on the tax treatment of transaction costs. In addition to addressing the limitation in deduction based on the participation exemption, the Dutch tax authorities addressed the allocation of transaction costs, for example, to a seller or the target. On the basis of the allocation test, it should be assessed (i) which entity in particular benefits from the activities and/or revenues causing the costs, (ii) has a motive to incur the costs, and (iii) would, under arm’s length terms, bear such costs. In case costs are incurred by a taxpayer which are allocable to another party, deduction may be denied on this basis.

Updated participation exemption decree

Subsequently, on 20 September 2024, the decree of the State Secretary of Finance regarding the participation exemption was updated. Key elements of this decree are:

- The allocation test should be addressed before assessing whether the participation exemption may result in non-deductibility of costs.

- Warranty & indemnity insurance premiums are considered non-deductible acquisition costs. On the basis of a balanced outcome, payout under such insurance is exempt by virtue of the participation exemption.

- Salary costs of employees working on a transaction may qualify as non-deductible transaction costs, regardless of whether such costs would have arisen absent the transaction.

Takeaways and tips

The year 2024 gave more insights into the tax treatment of transaction costs and the Dutch tax authorities’ view thereon. Attention should be given to potential non-deductibility of transaction costs, especially in relation to internal costs.

The Dutch Minimum Tax Act 2024 has taken effect during 2024 and the upcoming entry into effect of the Undertaxed Profits Rule in 2025 gives rise to new challenges.

The Netherlands implemented its domestic Pillar Two legislation through the Dutch Minimum Tax Act (Wet Minimumbelasting) at the end of 2023. The Income Inclusion Rule (“IIR”) and Qualified Domestic Top-up Tax (“QDMTT”) have been effective from 31 December 2023 and the Undertaxed Profits Rule (“UTPR”) will take effect as of 31 December 2024.

On Dutch Budget Day 2024, legislative amendments were proposed to incorporate further administrative guidance released by the OECD/Inclusive Framework and certain technical changes to the Dutch Minimum Tax Act. The legislative proposal is expected to be passed by parliament before the end of the year and largely has retroactive effect until 31 December 2023.

As a result of this legislative proposal, the February 2023 and July 2023 Administrative Guidance are considered to have been fully incorporated, and the December 2023 Administrative Guidance has been partially incorporated. Notably, the proposal incorporates the amendments to the Transitional Country-by-Country Reporting (“CbCR”) Safe Harbour from the December 2023 Administrative Guidance. This includes application as of 2025 of the rules on Hybrid Arbitrage Arrangements entered into after December 15, 2022. It is currently still under review to what extent the remainder of the December 2023 Administrative Guidance and the June 2024 Administrative Guidance requires further legislative changes.

The technical amendments notably include amendments on the application of the QDMTT to joint ventures and clarifications on the QDMTT Safe Harbour.

Takeaways and tips

- In addition to the existing complexity of the Pillar Two rules, the different paces of adoption of the Pillar Two rules and Administrative Guidance in different jurisdictions poses an additional challenge for in-scope MNEs. Loyens & Loeff is experienced with navigating these uncertainties and can provide you with expert advice how to interpret these complexities.

- Given the major compliance and data challenge that the Pillar Two rules introduce, we recommend focusing on the application of the Transitional CbCR Safe Harbour in as many jurisdictions as possible. Our Pillar Two team is available to review the qualification of a CbC report as a “Qualified CbCR” and the application of the Transitional CbCR Safe Harbour Tests in the respective jurisdictions.

- As the end of the first year in which Pillar Two applies is nearing, MNEs should further determine and confirm the impact thereof and include the Top-up Tax impact in their 2024 annual accounts. Our Pillar Two team is available to assist with this analysis and have discussions with your auditor on this topic.

- With the upcoming entry into effect of the UTPR, the Pillar Two rules will have a broader application. MNEs should review their structure for the UPTR risks and exposure and determine where Top-up Tax and compliance obligations can arise. Loyens & Loeff can assist you with an analysis of these risks and optimising your structure.

Public Country-by-Country (“CbC”) reporting obligations apply to (i) EU headquartered MNEs, and (ii) non-EU headquartered MNEs that have medium or large-sized subsidiaries or branches in the EU. The scope is limited to MNEs with consolidated annual revenues exceeding EUR 750 million in the last two consecutive financial years. Public CbC reporting applies to financial years starting on or after 22 June 2024 but may in certain EU jurisdictions apply before that date. Most in-scope MNEs must publish their first Public CbC report by 31 December 2026, in relation to the financial year 2025.

The financial data to be provided in the Public CbC Report should be presented on a jurisdictional basis (i) for each EU Member State and Liechtenstein, Norway and Iceland, and (ii) for each tax jurisdiction that qualifies as a non-cooperative tax jurisdiction as indicated by the Minister of Legal Protection. Information regarding all other jurisdictions can be presented on an aggregated basis.

The information will need to be made publicly available on the website of the MNE and filed with the local trade register, using a common template and in a machine-readable format.

Takeaways and tips

- Due to differences in the definition of MNE (OECD – inclusion of companies that are excluded from the consolidated financial statement due to size or materiality grounds) and use of conversion rates (OECD – January 2015), it should be verified to what extent a Dutch ultimate parent undertaking, a Dutch medium-sized or large subsidiary or a Dutch branch is required to publicly disclose a CbC Report on its own website and which conversion rate should be used.

- Member States and Liechtenstein, Norway and Iceland, have their own definition of medium-sized or large subsidiary and therefore it should be verified whether any local obligation exists to publicly disclose a CbC Report.

- To avoid potential discussions with tax authorities, we recommend preparing a CbC Report that is fully in line with the OECD CbC Report. To the extent the content of the publicly disclosed CbC Report will deviate from the OECD CbC Report, we recommend including a narrative of such deviations.

- We also recommend preparing a red-flag report to identify potential discussions points that might follow from the CbC Report. Furthermore, it may be helpful to prepare a standardised Q&A that may be used when questions arise from the public.

Currently, the Dutch tax entity classification rules differ from international standards, which in practice results in unintended hybrid mismatches and corresponding attention points in international (fund) structures, i.e., ATAD2 and withholding taxes.

As of 1 January 2025, new Dutch tax entity classification rules will enter into force, which aim to align the Dutch classification rules with international standards. For a detailed overview of changes, see our Quoted and Website post.

The changes to the Dutch tax entity classification rules will, in principle, result in (foreign) limited partnerships to no longer be treated as non-transparent from a Dutch tax perspective. This should reduce the amount of mismatches in classification of entities from a Dutch perspective, often occurring in international investment fund structures. To mitigate adverse consequences for existing structures, transitional rules apply during 2024, but these may not bring relief for all impacted structures.

As part of the Dutch tax entity classification rules, the classification of the Dutch mutual fund (fonds voor gemene rekening or “FGR”) and foreign equivalent legal forms will also be impacted. In case a foreign legal form is considered equivalent to a Dutch FGR, it may still classify as non-transparent under the new rules, if: (i) it is an investment fund (AIF / UCITS), (ii) established for collective investment, (iii) with a strategy that is classified as “normal” portfolio management, and (iv) the participations issued are freely tradeable. Currently, it is still unclear, due to limited guidance being available, when a foreign legal form will be considered equivalent to a Dutch FGR. If a foreign legal form would be considered equivalent to a Dutch FGR under the new rules, it may continue to be non-transparent, or even become non-transparent whilst currently classifying as transparent.

In this regard, the Dutch government has recently amended the Tax Plans 2025 to allow for a broader transitional regime for Dutch FGRs and foreign equivalent legal forms that want to include a redemption mechanism in the legal documentation in order to (continue to) classify as transparent under the new rules (also see our Website post). In addition, the Dutch government will investigate the complications caused by the new classification of the FGR and inform the Dutch parliament before 1 July 2025.

In July 2024, the European Commission initiated an infringement procedure against the Netherlands for failing to extend its dividend tax reduction scheme to foreign investment funds which are comparable to Dutch investment funds. The Commission considers that the relevant remittance reduction scheme (afdrachtsvermindering) restricts the free movement of capital by a discriminatory treatment of investment funds of other EU/EEA States.

Based on Dutch Supreme Court rulings of 2021 and 2024, foreign investment funds are denied access due to the alleged incomparability to investment funds based in the Netherlands. The tax authorities and courts have been denying dividend tax relief accordingly. With this infringement procedure, it is clear that the Commission holds a diverging view, calling on the Netherlands to bring its rules on taxation of investment funds in line with EU law. If the Netherlands fails to resolve the issue, it may be escalated to the Court of Justice of the European Union (“CJEU”).

Takeaways and tips

- Dividend tax reclaim applications in the name of non-resident Undertakings for Collective Investment in Transferable Securities (“UCITSs”) and (multi-investor) Alternative Investment Funds (“AIFs”) can be expected to be rejected by both the Dutch tax authorities and the Dutch courts. However, fund management companies may consider filing dividend tax reclaim applications and maintain filed applications to preserve their claims in view of potential future developments, including the infringement procedure.

- If the infringement procedure results in a ruling of the CJEU deviating from the Dutch Supreme Court rulings, foreign funds may be able to request a revised decision from the Dutch tax authorities for their preserved claims, pursuant to the Kuhne & Heitzprecedent set by the CJEU. In addition, the Dutch legislator may be moved to amend the remittance reduction scheme.

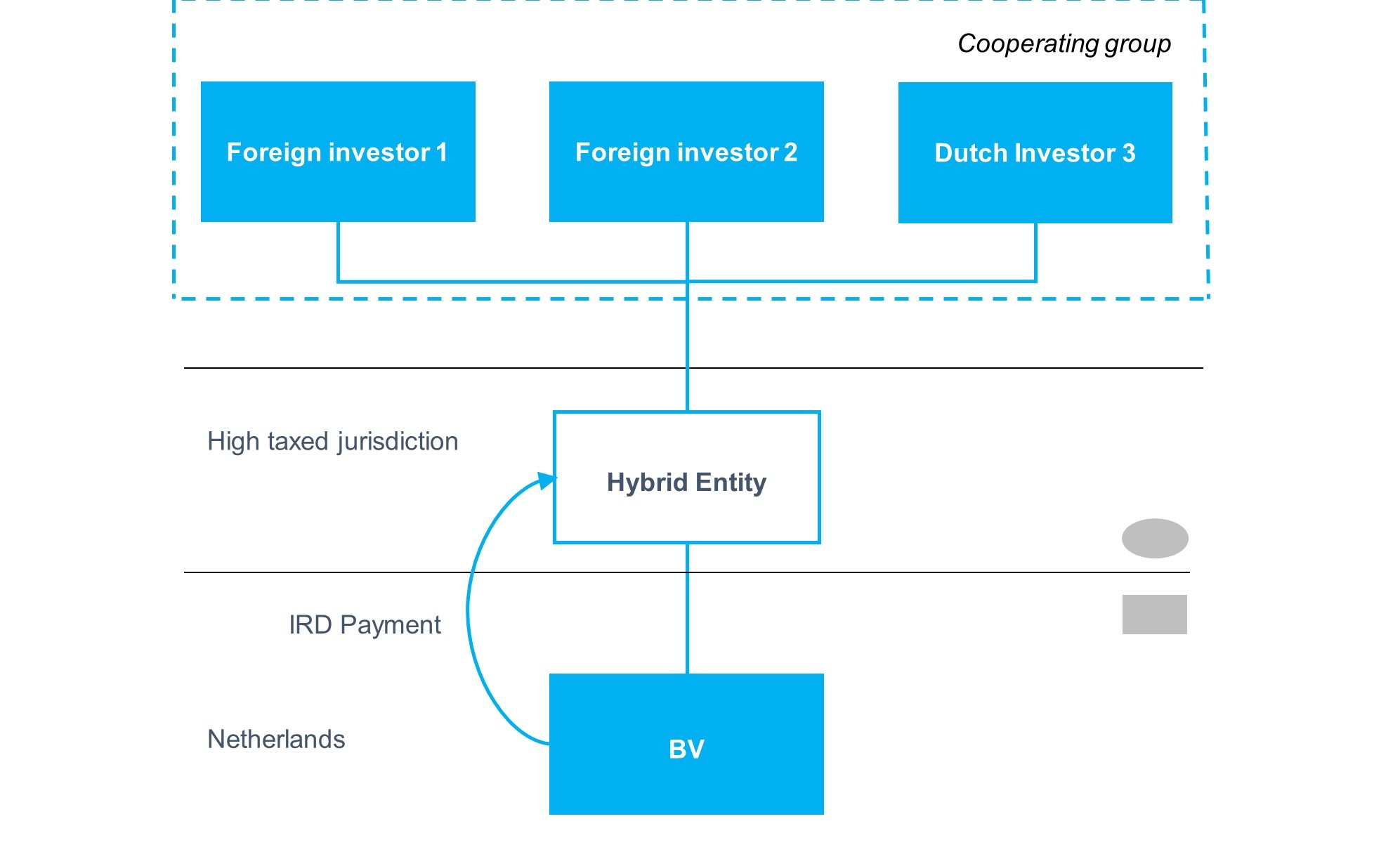

The Netherlands levies a conditional withholding tax (“CWT”) on interest, royalty, and dividend payments (“IRD Payments”) to affiliated entities in low-tax jurisdictions (“LTJs”) or in jurisdictions that are included on the EU blacklist. This CWT also applies to payments to certain hybrid entities and in abusive situations. Affiliation is based on the presence of a qualifying interest. A qualifying interest is an interest based on which directly or indirectly a decisive influence (i.e., control) can be exercised on the decision-making process. According to parliamentary history, this criterion is met if more than 50% of the voting rights can be exercised. A qualifying interest may be held independently or through a “cooperating group” that collectively holds a qualifying interest.

For the definition of a cooperating group in the Withholding Tax Act 2021 (“WTA”), reference is made to the cooperating group as stipulated in article 10a of the Dutch corporate income tax act 1969 (“CITA”). The cooperating group has deliberately not been defined in the CITA or in any other guidance issued by the Dutch legislator and is currently interpreted strictly by the Dutch tax authorities. In practice, this creates uncertainty, particularly because the Dutch tax authorities do not provide certainty in advance regarding the presence or absence of a cooperating group. Additionally, the current definition may lead to the levy of CWT in structures where it is not intended. The Tax Plans 2025 use the following structure to explain the overkill:

In situations involving a “regular” Hybrid Entity as reflected above, the Hybrid Entity is considered the beneficiary of the IRD Payment from a Dutch tax perspective. Based on the WTA, the “regular” Hybrid Entity is subject to CWT, unless it can be demonstrated that each affiliated participant in Hybrid Entity:

- is considered the beneficiary of the IRD Payment in the jurisdiction in which it is located; and

- is not a tax resident in an LTJ.

In the example, the tax classification of the Hybrid Entity by all investors is relevant in case they form a cooperating group. Dutch Investor 3, similarly to BV, will classify the Hybrid Entity as the beneficiary of the IRD Payment. Therefore, the IRD Payment by BV to Hybrid Entity will be fully (“all or nothing”-approach) subject to CWT.

To combat this overkill and adverse impact on the Dutch investment climate, the government proposes a new group definition in the Tax Plans 2025: a "qualifying unit". A qualifying unit is present in situations where entities act jointly with the main purpose, or one of the main purposes, of avoiding the levy of CWT from one of those entities. In this context, the burden of proof regarding the existence of a qualifying unit is with the tax authorities.

The proposed definition of a qualifying unit requires that the following two conditions are met:

- entities must be “acting together”; and

- the joint cooperation must have the main purpose, or one of the main purposes, of avoiding the levy of CWT at the level of one of those entities (“Avoidance Test”).

According to the Tax Plans 2025, the new group definition in the WTA should provide room to obtain advanced tax rulings regarding the application of the qualifying unit.

Given the welcome introduction of the Avoidance Test in the qualification of a qualifying unit, coupled with the examples provided in the Tax Plans 2025 and the opportunity to obtain certainty in advance regarding this topic, it is expected that only structures that are set-up to avoid CWT will be targeted.

Takeaways and tips

- The new definition of qualifying unit should significantly reduce the number of situations where payments to hybrid entities are in scope of the CWT, particularly in view of the required intention to avoid CWT. Furthermore, the new entity classification rules entering into force as of 1 January 2025 should resolve the number of hybrid entities altogether.

- MNEs should verify whether a ruling confirming the absence of a qualifying unit is preferred.

As per 1 January 2026 the default real estate transfer tax (“RETT”) rate of 10.4% will no longer apply to the acquisition of residential real estate. For the acquisition of residential real estate, a new RETT rate of 8% is proposed as of 1 January 2026.

The 8% RETT rate for residential real estate is expected to only apply if at the time of acquisition, the acquired real estate is “in its nature fit for residential purposes”. The 8% RETT rate is therefore not expected to apply to the acquisition of existing non-residential real estate that – after acquisition – will be redeveloped or transformed to residential real estate. Typically, the execution of the deed of transfer constitutes the RETT taxable event and the date of execution is decisive for the applicable RETT rate.

Abolished activities from reduced VAT rate

The Tax Plans 2025 include a proposal to abolish the reduced 9% Dutch VAT rate for the following activities per 1 January 2026:

- supplies of newspapers, magazines and (e-)books;

- short stays in hotels, guest houses and other holiday businesses;

- the admission to museums, theatres, stage and music performances;

- the admission to sporting events and the supply of sports season tickets;