Background

As of 1 January 2022, the Netherlands has anti-abuse legislation against double non-taxation through transfer pricing mismatches. Amongst others, in case of transfers of assets and liabilities through contributions, distributions, mergers and demergers, according to Article 8bd Dutch Corporate Income Tax Act (CITA) the Dutch corporate income tax (CIT) base for the recipient is at maximum (for assets) or at minimum (for liabilities) the value included in the transferor’s tax base. This legislation has led to uncertainty with respect to the exact scope of this provision in relation to non-arm’s length transactions between two foreign subsidiaries of Dutch parent companies.

The DTA has recently published the third helpful KG Position on the scope of Article 8bd CITA. The KG Positions contain the DTA’s interpretation of the tax aspects of specific issues that were presented to the respective KG. As the KG Positions constitute policy of the DTA, taxpayers can rely on them as of their publication date. For more details of the other two helpful KG Positions, we refer to our previous website post.

Facts and circumstances

This KG Position covers the following situation:

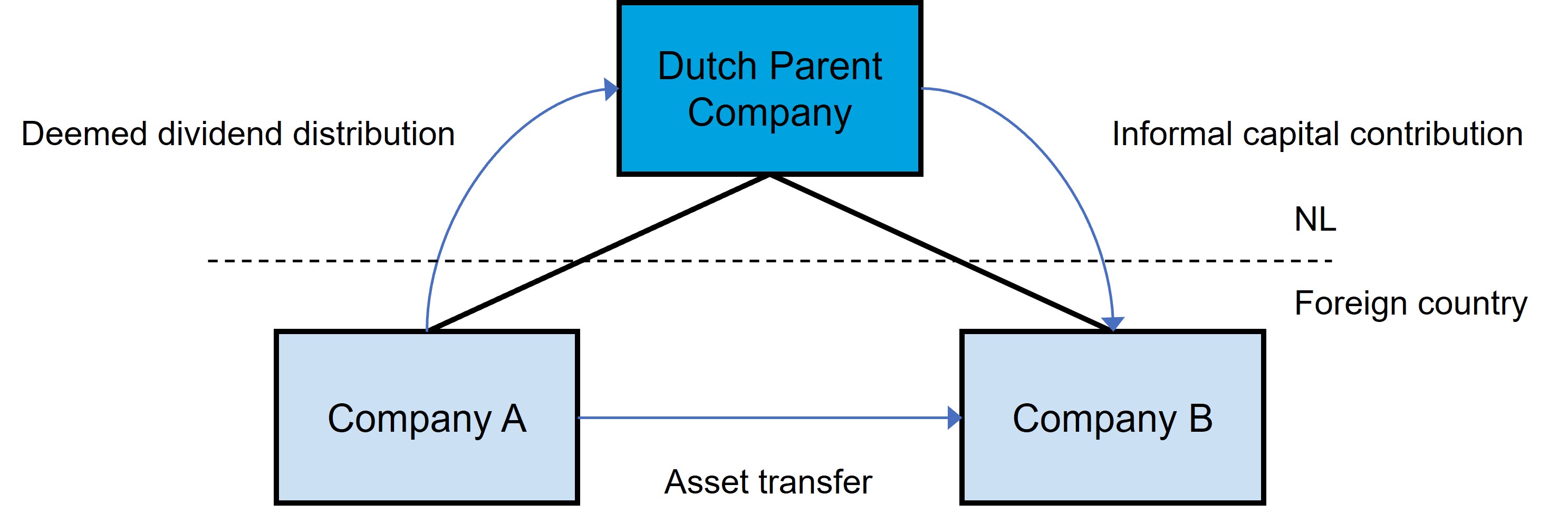

A Dutch Parent Company holds all the shares in two foreign subsidiaries, Company A and Company B both resident in the same jurisdiction. Company A transfers an asset to Company B at book value, while the fair market value of the asset exceeds the asset’s book value. In the jurisdiction of Company A and Company B, the transfer of the asset is not corrected to an arm’s length value for tax purposes. Hence, Company B receives the asset for a lower than arm’s length value from Company A. For Dutch CIT purposes and in accordance with Article 8b CITA, the benefit provided by Company A to Company B is deemed to be provided through the Dutch Parent Company. Accordingly, the transfer of the asset below fair market value constitutes a deemed dividend distribution to the Dutch Parent Company equal to the difference between the asset’s fair market value and its book value, immediately followed by a contribution of the same amount as an informal capital contribution into the Company B. Reference is also made to the illustration below.

Article 8bd CITA provides that the value of a transferred asset through a distribution is at maximum the value included in the transferor’s tax base. In the above situation, Company A would not take into account any value for the distribution, which would need to be mirrored at the level of the Dutch Parent Company in case a strict reading of Article 8bd CITA would be followed. In case of application of Article 8bd CITA, the subsequent informal capital contribution would result in recognition of profit at the level of the Dutch Parent Company equal to the difference between the fair market value and the book value of the asset. In this respect, the question arose whether this situation actually involved the acquisition of an asset by the Dutch Parent Company to which Article 8bd CITA refers and that would be affected by the transfer pricing mismatch legislation.

With reference to how the acquisition of an asset should be interpreted under Dutch civil law, the DTA’s KG starts with the preliminary conclusion that the fact pattern as outlined above does not involve the acquisition of an asset by the Dutch Parent Company from a civil law perspective. The KG then continues with an assessment of Dutch case law, and the aim and Dutch parliamentary history of Article 8bd CITA, including the Article 8bd CITA decree of the Dutch State Secretary of Finance of 11 January 2023 (the Decree, for more details hereon we refer to our website post), and concludes that these do not provide reasons to deviate from this civil law qualification for the purpose of Article 8bd CITA. Hence, the KG takes the position that the fact pattern does not fall in scope of Article 8bd CITA.

Our view

The third KG Position on Article 8b CITA again offers helpful clarification of the DTA’s view on the scope of the Dutch transfer pricing mismatch legislation, this time in respect of deemed dividend distributions to Dutch parent companies due to non-arm’s length transactions between foreign subsidiaries. Although the KG Position relates to a specific fact pattern, arguments can be derived from it to substantiate the non-application of Article 8bd CITA to other Dutch parent companies in similar situations. Based on the principle of legitimate expectations (vertrouwensbeginsel), taxpayers can rely on this KG Position as of its publication date, 31 January 2025.

To obtain certainty in advance or where situations differ from the fact pattern as covered by this KG Position, taxpayers may still consider applying for an advance tax ruling to confirm the non-applicability of Article 8bd CITA. Also, for obtaining an advance tax ruling these KG Positions and the Decree offer helpful guidance and support to taxpayers on the line of reasoning of the DTA concerning the scope of Article 8bd CITA.

Should you have any questions on this topic, please contact a member of our Transfer Pricing Team or your regular trusted Loyens & Loeff contact.